Index breaks 6,000-point mark on CPC congress opening

By Li Zengxin (chinadaily.com.cn)

Updated: 2007-10-15 16:37

Updated: 2007-10-15 16:37

After hesitating last week before another milestone, the benchmark Shanghai Composite Index today broke 6,000 points, in time with this morning's opening session of the 17th National Congress of the Communist Party of China (CPC).

The index, having for the first time surpassed the 5,500-point mark the day prior to the week-long national holiday, gained another 500 points in just six trading days beginning October 8.

Total turnover of the stocks in the major indices was 268.9 billion yuan, the second largest since the holiday after last Friday's 308.8 billion yuan.

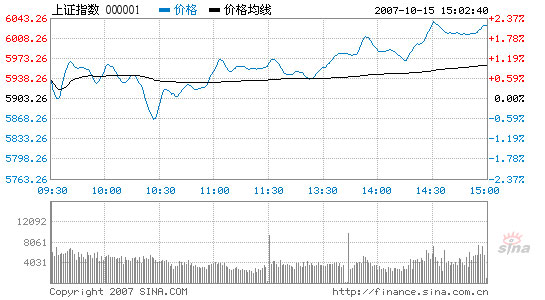

Shanghai Composite Index

Source: sina.com.cn

Opening higher at 5,934.78, the Shanghai index fluctuated at the beginning and fell to a 5,866.13 point low. Then it turned up again to just below the critical line. In the afternoon, after the congress called a break, it geared up and broke the 6,000-point, remaining above it for the rest of the day. The index closed at 6,030.09, 162.82 points or 2.15 percent higher than last Friday, and a few points down from the day's high of 6,039.04.

Of the A shares listed in Shanghai, 350 went up, 424 closed down and 69 ended flat, indicating another lift of index by large-cap heavyweights. Baoshan Iron and Steel climbed 10.03 percent to lead 31 stocks hitting the maximum growth cap of 10 percent, topping the gainers list.

China Unicom, with the largest trading volume, rose a stunning 9.97 percent to 11.69 yuan. China Shenhua Energy, with the largest transaction value, stumbled to become another "100-yuan share," falling 1.36 percent to 90.87 yuan.

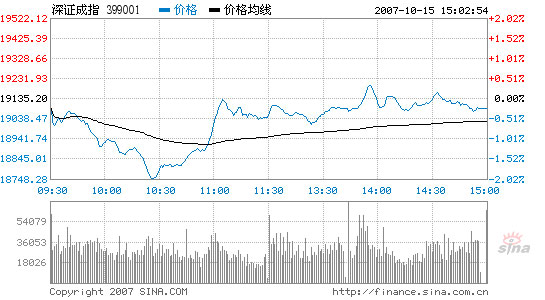

Shenzhen Component Index

Source: sina.com.cn

The Shenzhen Component Index, tracking the Shenzhen Stock Exchange lacking of index-driven large-cap stocks, lost 46.54 points or 0.24 percent to 19,088.66. After opening lower at 19,084.83, it went through the day within a range of between 18,745.68 and 19,199.35.

Of the A shares, 276 closed up, 293 dropped and 82 remained unchanged. The largest trader China Vanke fell almost 5 percent to drag the index down.

Stocks in the construction, food and finance sectors were particularly strong today. Bank shares moved up modestly with Bank of Communications on the top with a 3 percent rise, and contributed the most to the index growth due to their heavy weights in the market. CITIC Securities moved up 1.58 percent on news of its newly acquired license as a qualified domestic institutional investor.

China Construction Bank (CCB), which issued 9 billion A shares last month, will join the major indices tomorrow. On last Friday's closing price, the value of floating shares of CCB accounted for 1.1 percent of total worth of all securities listed in the Shanghai bourse, and 0.7 percent of the total market value of the stock market. On the total market value of all shares including locked-up non-tradable shares, CCB weighted 0.4 percent in Shanghai and 0.3 percent in the stock market last Friday.

|

|