|

BIZCHINA> Center

|

|

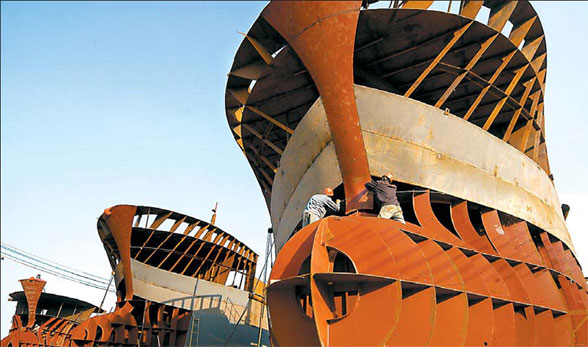

Shipbuilders grab more global market

(China Daily)

Updated: 2008-04-28 10:02

In a Shanghai shipyard, a gigantic 8,530 TEU container ship is ready for its maiden voyage. At the same time, in a drydock in northeast Dalian, a 300,000-ton oil tanker is ready for delivery. Such high value and sophisticated vessels, which were the domain of South Korean and Japanese shipbuilding industries before, are now good examples of China's drive to surpass its neighbors in the global shipbuilding market. As the race between the countries intensifies, China, the world's third largest shipbuilder (behind No 2 Japan and No 1 Korea), has upgraded its ships from conventional crude oil tankers and bulk carriers into high value-added vessels, such as high-speed containerships, liquefied natural gas carriers and very large crude oil carriers. And in terms of shipbuilding orders, Chinese companies have already exceeded South Korea and Japan. According to a British report, China shipbuilders had orders for 14 million CGT Compensated Gross Tons (CGT -ship's capacity measure) in January 2008, accounting for 50 percent of the world's total. South Korea had orders of 600,000 CGT and Japan had 300,000 CGT. In terms of new orders, China was actually No 1 last year, totaling 98.5 million deadweight tons and taking a global share of 42 percent, up 12 percentage points from a year earlier and exceeding South Korea. The growth of the Chinese shipbuilding industry was relatively rapid, though for more than ten years, the country has been playing catch-up with Japan and South Korea. China has been the world's third largest shipbuilder for 12 years. By 1995, Chinese shipbuilders replaced Germany in the third spot with a 5 percent market share in the world. By 2006 the country's global market share increased to 18 percent in 2006 when South Korea had 35 percent, followed by Japan with 25 percent in 2006. In 2007, the country lifted its market share to 25 percent, according to a report from Morgan Stanly. The strong growth has made many observers bullish on China's shipbuilding future and they expect it to surpass South Korea to become the global leader. "Although some have a different prospective about the country's shipbuilding sector, we are positive about its growth in the long run," Hu Song, a researcher with Bank of China International Securities says. Researchers at Morgan Stanly believe the global shipbuilding industry is relocating from Japan and South Korea to China, and expect the country to surpass Korea and top the global market by 2015. (For more biz stories, please visit Industries)

|