|

BIZCHINA> Center

|

|

Related

Investors retreat from speculative gains

(China Daily/Agencies)

Updated: 2008-05-30 09:42

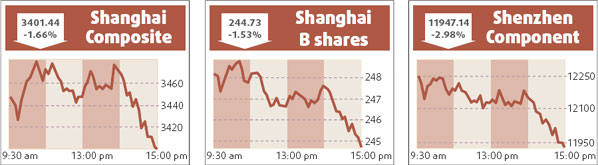

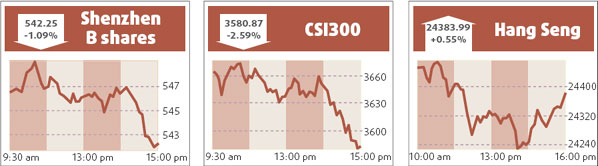

Shanghai stocks fell yesterday as brokerages and banks pulled back from gains made on speculation that authorities might soon announce the long-delayed launch of stock index futures. The Shanghai Composite Index ended down 1.66 percent at 3401.437 points, just off its low of 3400.773. Turnover in Shanghai A shares was very small at 67.1 billion yuan (about $9.6 billion) against Wednesday's 68.4 billion. CITIC Securities, up 6.16 percent on Wednesday, lost 4.69 percent to 32.69 yuan yesterday. Industrial & Commercial Bank of China fell 1.35 percent to 5.83 yuan after rising 1.9 percent on the previous day. However, oil refiners climbed with Sinopec up 2.58 percent to 13.12 yuan amid speculation that the government might provide it with further financial aid to offset high global crude oil prices - perhaps by removing its windfall production profit tax. Analysts said the recent flurries of buying in sectors such as brokerages and oil refiners, on tenuous speculation about possible policy changes, demonstrated investors were reluctant to buy into the overall market because of concern about high inflation and this year's economic growth outlook. "The only impetus to the market on Wednesday was speculation about index futures, it's speculation about oil refiners (yesterday). Speculation dominates the market these days, because the market as a whole is increasingly worried about inflation," said Qiang Xiangjing, analyst at CITIC-Kington Securities. Among other gainers yesterday, Dongfang Electric Corp surged 3.21 percent to 33.10 yuan after it was reported the government had injected 500 million yuan into the company's parent group to help it recover from the earthquake.

HK stocks firmer Hong Kong stocks rose 0.55 percent yesterday, tracking firmer regional markets, after data showed surprisingly strong US business spending. The benchmark Hang Seng Index ended at 24383.99, helped by a 4.2 percent rise in Asia's top refiner Sinopec. But the index's gains were capped by a 3.2 percent loss in CNOOC. Mainboard turnover was HK$64.09 billion, up slightly from HK$60.21 billion on Wednesday. Trading volume of warrants accounts for over 20 percent of daily market turnover, and brokers said the scam could further shrink the stock market's already low turnover. The China Enterprises Index of Hong Kong-listed mainland companies, or H shares, rose 1.03 percent to close at 13511.86. (For more biz stories, please visit Industries)

|