|

BIZCHINA> Top Biz News

|

|

Related

Net 263 says to buy 50% stake in iTalk

By Wang Xing (China Daily)

Updated: 2008-12-18 07:53

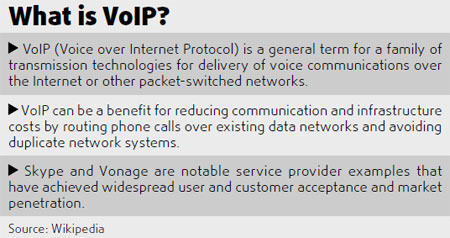

Chinese Internet and communication technology company 263 Network Communications yesterday said it would acquire a 50 percent stake in US telecom service provider iTalk Global Communications. This is the first time that a private Chinese telecom service company has decided to expand in a foreign market. 263 will buy new shares of iTalk and will eventually control half of the stakes in the US' third largest VoIP (Voice over Internet Protocol) service provider. Although both sides declined to disclose the deal details, it was reported that 263 might pay over 100 million yuan for its first foreign acquisition. Li Xiaolong, chairman of 263 Network Communications, said the current economic slowdown would not deter 263 from its expansion plans. He said the new partnership would help 263 to gain experiences in running the VoIP business. Compared with traditional telecommunication services, VoIP is a cheaper way of communication that enables voice calls via Internet. The service is currently not fully available in China, with telecom operators expressing fears that the service may hit their voice revenues. Li, however, said he expects VoIP services to be fully opened up in China in the future. He said the partnership with iTalk would give 263 a unique advantage. As one of the first telecom service companies in China, 263 provides services in IP telephony, voice conferencing and e-mails and has been looking forward to entering the VoIP market for years. The cash-rich company clocks annual profits of nearly 100 million yuan, according to sources.

Zhao Jie, iTalk's CEO, said the partnership with 263 would help fuel iTalk's expansion outside North America. As one of the largest VoIP service providers in the United States, iTalk has a wide user base in VoIP markets in the United States and Canada. Its revenue was expected to amount to $200 million this year, Zhao said. The company has been looking for funds from venture capitals to sustain its expansion plan but failed to do that because of the financial crisis. The company signed a cooperation letter of intent with 263 in September. However, the deal was not approved by the Chinese government until earlier this month.

(For more biz stories, please visit Industries)

|