|

BIZCHINA> Top Biz News

|

|

Snow gets set to acquire Amber

By Ding Qingfen (China Daily)

Updated: 2009-03-17 07:43

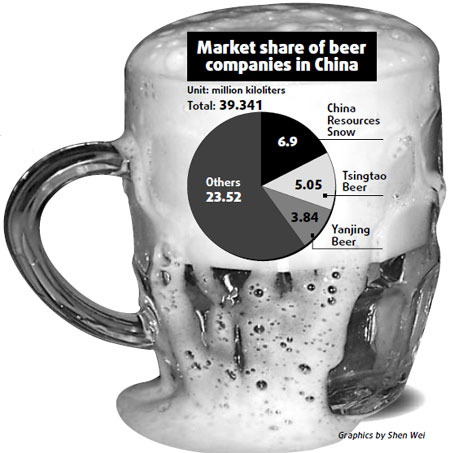

China Resources Snow Breweries (Snow), the nation's largest brewery by annual output, said it has made an offer to buy Shandong-based Amber Breweries (Amber) for 285 million yuan to enhance its presence in the Shandong market dominated by Tsingtao beer.

Snow said that after the acquisition, it will inject 54 million yuan to upgrade Amber's production facilities to raise annual output to 300,000 kiloliters from 270,000 kiloliters. Shandong is one of China's largest beer consumption provinces. Tsingtao Beer, the nation's second largest brewer, has a stranglehold of more than 40 percent share of the market. "The acquisition will help Snow increase its market share in Shandong, China's largest beer consumption market," said Chen Lang, executive director, China Resources Enterprise Ltd. Snow is a 51:49 joint venture between Hong Kong-listed China Resources and London-based brewer SABMiller. Shandong is ranked second after Guangdong in terms of the GDP it generated last year. Statistics also show that Shandong annually consumes 10 percent of the nation's beer output, followed by Fujian, Guangdong and Jiangsu provinces. Although it had a sales network in Shandong, Snow had no factory there. Last year, about 80,000 kiloliters of Snow beer were sold in Shandong. The deal is expected to challenge Tsingtao's dominant position in the Shandong market, said Teng Wenfei, food and beverage analyst, Shanghai Securities. According to Tsingtao's 2008 interim financial report, out of its total sales of 9 billion yuan, about 53 percent, or 4.76 billion yuan, came from Shandong province alone. "The deal will see an erosion in Tsingtao's position in Shandong," said Teng. Executives from Tsingtao were not reachable for comments. Since early this year, Snow has been aggressively expanding capacity through mergers and acquisitions nationwide despite the economic slowdown. Before the Amber deal, the company purchased three regional brands located in Anhui, Zhejiang and Liaoning provinces for 749 million yuan. Tsingtao and Yanjing Beer, however have not made any such moves till now. "The acquisition cost is lower now, and from a long-term view, China's brewery industry is promising thanks to the population. This is what is motivating Snow," said Teng. The profit margin in the industry is also higher. Last year, breweries raised prices of beer by 10 percent due to the soaring price of barley, a major ingredient in beer making. But this year, the price of barley has dropped to $363 per ton from the high of $450 in 2008. "The price drop in barley makes the brewery business more profitable," said Teng. According to the National Bureau of Statistics, China's total beer output in the first two months of 2009 rose 12.9 percent from a year earlier to 4.97 million kiloliters, reversing the sluggish trend in 2008. (For more biz stories, please visit Industries)

|

|||||