|

BIZCHINA> Top Biz News

|

|

Multinationals battling locals for market share

By Andrew Moody (China Daily)

Updated: 2009-03-30 07:59

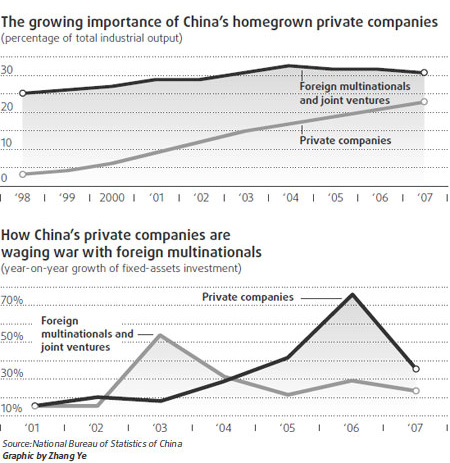

Big American and other foreign multinationals are finding it increasingly tough to keep China's rising corporate stars at bay as they fight for market position in the world's fastest-growing market. The world's mightiest brands, which once regarded doing business in China as rich pickings, are now being bloodied as they battle for market share. In the past 10 years, according to the National Bureau of Statistics of China, Chinese companies have increased their market share more than seven fold from 3 to 23 percent, while foreign multinationals have only grown their market share from 25 to 31 percent. The likes of Procter & Gamble, Nike, Adidas, Sony, Nokia and Nissan now have to go head to head with local competition. Sportswear retailer Li Ning, fashion footwear makers Belle International and Aokang, home appliance maker Haeir and TV maker Konka are among many Chinese companies up for the fight. Some have become so prominent they have become attractive acquisition targets for big players such as Coca-Cola, which had its $2.3 billion bid to buy top local juice maker Huiyuan thwarted on competition grounds by China's Ministry of Commerce. The current economic downturn adds further heat to the battle, with the China market offering a potential port in a storm for foreign companies which have seen their usually stable western markets collapse in a matter of months. China's private companies are ready for any extra challenge. They have invested heavily over the past few years in fixed assets, from a year-on-year growth rate of 15 percent in 2001 to 36 percent in 2007 - a more rapid rate than the investment level increase of 15 to 23 percent by foreign multinationals over the same period. Over the next decade or so, Chinese companies might even have loftier ambitions than just the China market and could build into global brands themselves.

James Hexter, senior partner at management consultants McKinsey & Co in Beijing, said Chinese companies becoming world players is a possibility. "I think it would be unwise to bet against the emergence of large Chinese companies with global brands," he said. He insisted that for all companies, wherever they operate, how they fare in China will be key to their eventual global success. "The way I think about it is that it is a bit of race and that companies have to win in the China market to succeed." He said winning in China is not necessarily just about securing the greatest share in the domestic market. It could mean building a supply in China that provides a platform from which to attack international markets, employing the country's best talent or that the products developed for the China market are sufficiently cutting edge to win in other markets. "It means that in whatever way your industry is impacted by China, you have to meet that challenge," he said. One area in which the foreign multinationals will want to make inroads in China, either directly by importing or through their joint ventures, over the next 12 to 18 months is the car market. While sales of cars in China may have fallen by 8 percent in January, the market is lively compared to conditions faced in the US and Europe, where sales have slumped by as much as 70 percent in some cases. Zhong Shi, an automotive analyst and associate editor of China Automotive Review, said there will be a period of intense competition between Chinese manufacturers and their foreign rivals. "The China market might not be easy but foreign companies are going to think they have more chances in this market than the western markets," he said. "China is going to be the leading market in the world over the next one or two years while the American and European markets are recovering. It is going to be a unique period." Chinese companies currently dominate the small cars market (cars with a 1.6 liter, or lower, engine capacity). The major players are Chery, founded in 1997 and based in China's Wuhu, Geely Automobile, a former refrigerator maker which went into motorcycles before making cars and BYD Auto, which makes hybrid vehicles and in which billionaire investor Warren Buffet has taken a 10 percent stake. The larger, more prestigious, vehicles are still the preserve of foreign companies in China. "I think it is more difficult for Chinese companies to cross the technological barrier to successfully make the more powerful vehicles. Another factor is that, when it comes to larger cars, Chinese consumers prefer foreign brands," Zhong said. Tian Bingzhang, partner in international management consultants AT Kearney in Shanghai, said Chinese companies have been successful in recent years in imitating the strategies of the multinationals. Private Chinese businesses, he argued, have set about developing better products and building brands but have focused on third and fourth-tier cities, which foreign companies had left untouched until recently. "They have done two things particularly well. They have begun to advertise through CCTV (China's national TV broadcaster) and build their brands and they have invested heavily in their distribution networks, giving a good margin to the distributors to carry their products. Private Chinese companies now own the third and fourth-tier cities." Frank Ingriselli, a former president of Texaco International Oil and who first came to China in 1982 to negotiate a major oil contract, said China's oil companies such as CNOOC and PetroChina are catching up with the major multinationals. "There is a little bit of a gap but it has closed dramatically over recent years," he said. Ingriselli, now chief operating officer of Pacific Asia Petroleum, a small energy company, said one of the reasons is that the international companies now sub contract a lot of their activities to vendor companies rather than carry them out in house. "These vendor companies are just as likely to take Chinese yuan as US dollars," he added. He said China's oil companies now also make a determined effort to retain their own top people. "What used to happen is that a lot of young Chinese students who went to universities abroad would go off and work for Exxon or Shell. Now the Chinese companies offer packages that are equally as good, to retain this talent." "In other primary industries such as mining, Chinese companies not only dominate the China market but are also becoming more aggressive internationally. Chinalco, China's aluminum giant, is in a battle to increase its stake in the Anglo-Australian mining conglomerate Rio Tinto from 12 to 18 percent, although it still needs the approval of Australia's Foreign Investment Review Board. Shenhua, in which international mining giant Anglo American held a stake until last year dominates China's coal mining industry, producing 200 million tons of coal a year. This makes it one of the world's largest coal producers, with an anual output similar to that of Peabody, the biggest producer in the US. Peter Markey, a mining industry leader and partner of Ernst & Young China in Shanghai, said it is difficult for foreign companies to get a foothold in China. "Within China mining is a big industry and very much dominated by Chinese companies and where foreign companies do get some action, it is usually with minority stakes," said Markey. He said that whereas many foreign companies have reverted to being purely mining operations, Chinese companies are continuing to invest in downstream and ancillary businesses. "They are trying to bridge the gap with international equipment manufacturers and this is evident at all the big mining conferences they hold here," he added. Within the domestic market, the real fight between Chinese companies and foreign multinationals could just be about to begin. The foreign multinationals have become attracted to the growing markets of the third and fourth-tier cities and see, like Coca--Cola, that one of the best routes in is by acquisition of local companies with readily built distribution systems. China's private companies similarly want to expand more in first and second-tier cities, armed with internationally recognizable brands they have snapped up in France and Italy, with consumers being unaware the products are made in the Chinese countryside. Tian Bingzhang at AP Kearney said multinationals and Chinese companies are now angling to grab market share in each others' strongholds. "It is very difficult to say who is going to be the eventual winner," he said. "From a Chinese economic point of view you want to see local companies rising up in a competitive global market and it is a delicate decision to create a market in which they can grow." Tian said it will be hard for private companies to maintain their current success over the longer term because of multinationals' accumulated knowledge and management capabilities, built up in some cases over 100 years. He said it is possible, however, that at least one Chinese private company will be a significant player in most major sectors within 20 years. "It will be those companies who are not carried away by their success and fix their problems and improve their organizational capabilities that are going to succeed," he said. (For more biz stories, please visit Industries)

|