|

BIZCHINA> Top Biz News

|

|

Shares end down as energy firms falter

(China Daily/Agencies)

Updated: 2009-05-27 08:08

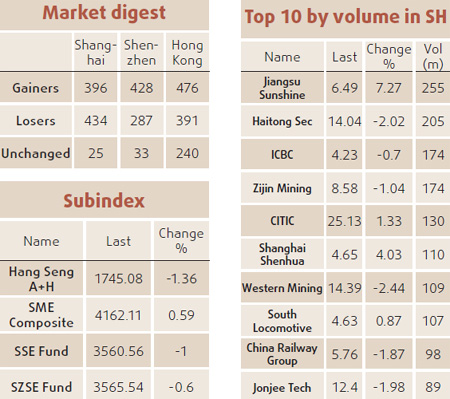

China's benchmark stock index fell to a two-week low as energy producers declined on lower oil prices, overshadowing a gain by Citic Securities Co on speculation that a resumption of initial public offerings would boost revenue. China Petroleum & Chemical Corp slid 1.6 percent to a three-week low, while China Shenhua Energy Co lost 3.3 percent on concerns that gains for this year overvalued prospects for an economic recovery. Citic Securities, trading for the first time this week, added 1.3 percent after the Shanghai Securities News reported on Monday that China may restart IPOs in June. "Most investors are still gauging the impact of new share sales and want to see more economic data to decide on whether to buy," said Wu Kan, a Shanghai-based fund manager at Dazhong Insurance Co. The Shanghai Composite Index, which tracks the bigger of China's stock exchanges, fell 21.44, or 0.8 percent, to 2,588.58 at close, the lowest close since May 11. The CSI 300 Index, measuring exchanges in Shanghai and Shenzhen, lost 1.2 percent to 2,719.76. The Shanghai index has rallied 42 percent in 2009 on optimism a 4-trillion-yuan stimulus package and removal of loan restrictions will revive growth as exports slump. Stocks traded on the gauge are valued at 26 times reported earnings, twice the 12.87 times they fetched in November.

Crude oil for July delivery fell as much as 1.9 percent to $60.51 in after-hours trading in New York yesterday. The decline drove an index of Chinese energy stocks on the CSI 300 index down 3.5 percent, the biggest drop in a month. The gauge has rallied 69 percent this year, the most among the 10 industry groups, as crude surged 35 percent and investors bet China's economy would rebound. Hang Seng falls Hong Kong stocks fell as investors took profit. The Hang Seng Index dropped 130.26, or 0.8 percent, to 16,991.56, its first close below 17,000 since May 15. The Hang Seng China Enterprises Index slid 1.2 percent to 9,684.07.

(For more biz stories, please visit Industries)

|