|

BIZCHINA> Top Biz News

|

|

Limited fiscal maneuverability

By Si Tingting (China Daily)

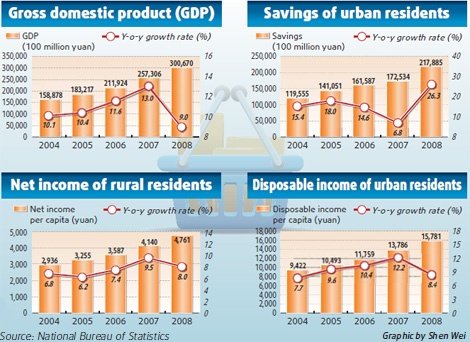

Updated: 2009-06-29 08:23 Contrary to this piece of good news, a Ministry of Finance review released on June 18 proposed that China should maintain its current tax threshold, as raising the tax threshold will lead to a reduction in total tax revenue and the government's investment in social security, education and healthcare. "Raising the tax threshold will eventually harm the interests of low-income families and the needy," the report, which is the first ministerial review of the country's income tax system, said. The government's concern in easing people's tax burdens has been echoed by Gerard Lyons, chief economist and Head of Global Research of the London-based Standard Chartered Bank. He pointed out that China is now building a social welfare system, whose first phase has been unveiled, and it has to look through the fiscal numbers to see how it will afford all that. Lyons suggested that China should avoid replicating Britain's mistake of charging high income taxes to build a very expensive but not very effective social welfare system. In this regard, Zhou urged the governments at various levels to cut their own administrative spending to partly meet the budget deficit. Closing the income gap All the stories of economic growth and prosperity form a gilded exterior that hides the unattractive truth inside that the profits go largely to the people at the top of the income echelons. Payment system reform has always been one of the top concerns of the Chinese government. Since 1987, the proposal had appeared and reappeared on the annual government work plan, whereas the focus had been shifting from fairness to efficiency and now back to fairness. China's Gini coefficient, an internationally accepted measurement of income equality, was estimated by some research organizations at 0.45 last year. The "alarm boundary" stands at 0.4. The coefficient was 0.3 in 1982 and 0.45 in 2002. Among the 131 countries in United Nations Development Program's updated survey, only 31 countries are in a worse situation than China in terms of equality in income distribution. In 2000, the richest 20 percent earned about 42 percent of the total income, whereas the poorest 20 percent earned just 6.5 percent of the total income.

According to Yao, China's income disparity is largely a result of low levels of urbanization (about 40 percent live in the city now) and the large labor poor in the rural areas. "About 40 percent of China's labor force are still engaged in agriculture, which offers mostly low-paying jobs," Yao said. Limited educational opportunities are another reason for the pay disparities. With fierce competition for entry to the top universities, those who do not make it to their desired colleges end up working for very low wages. In 2005, a person with a bachelor's degree eared 80 percent more than those with only a high school diploma, and a person with a master's degree earned 92 percent more than those with only a high school diploma. Zhu recalled, "One day, when I was little, my mother took me out to see the workers on a construction site. They slept in tents and ate leftovers from a nearby restaurant. My mother looked at me and asked me, 'Do you want to be like one of them and live such a poor life? If not, then study harder.'" This quote reflects what many uneducated Chinese people, especially those from rural areas, end up becoming, thus enlarging the income gap.

(For more biz stories, please visit Industries)

|

|||||