|

BIZCHINA> Top Biz News

|

|

Copper firm eyes capital to expand

By Wang Ying (China Daily)

Updated: 2009-07-24 08:04

After a four-day trading suspension, Yunnan Copper Co Ltd, the nation's third largest copper producer, said yesterday it would privately place 300 million new shares to raise about 6 billion yuan ($878.39 million) and use the money to expand production, purchase parent assets, and repay bank loans. The Shenzhen-listed copper maker said in a statement the new issue would target no more than 10 investors, at a price of 20.59 yuan or higher per share. Yunnan Copper, based in Kunming, revealed that of the total 6 billion yuan it expected to raise, 2.37 billion yuan would be used to buy five copper-related units from its parent company Yunnan Copper Industry Group (YCIG), 1.4 billion yuan to fund the Hongshan project to augment copper ore supply, and another 1 billion yuan to increase the company's liquidity.

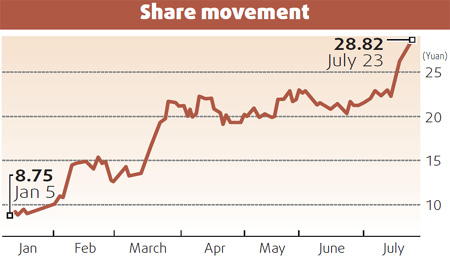

After the new issuance, YCIG will maintain its position as Yunnan Copper's largest shareholder, according to the statement. "The big-ticket issuance reflects the copper producer's confidence in the stock market and is a strategic move based on a long-term blueprint," said Zhao Yanhui, an industry analyst with Daton Securities. "From the future use of the raised money, we can understand Yunnan Copper's effort to integrate its industrial chain and strengthen its risk control ability. And these steps will generate a positive feedback to the copper maker in the long run," Zhao added. Public information shows that Chinalco, the nation's largest aluminum producer, is currently the largest shareholder of YCIG, holding a 49 percent stake. Over the past few years, Chinalco has integrated a handful of copper-related corporations, and obviously that is the preparation for forging listed Yunnan Copper as its copper platform, said Zhao. Boosted by the new issuance news, shares of Yunnan Copper hit the daily limit of 10 percent to 28.82 yuan apiece yesterday. The surge was seen not only in Yunnan Copper, but also swept the whole non-ferrous metal sector, which rose 1.07 percent. Since the beginning of the year, copper in Shanghai has jumped 83 percent. "Surely, the appreciation of the dollar and capital liquidity will affect the metals' prices, but the fundamental influence will be from supply and demand," said Li Li, an analyst with Qilu Securities.

Meanwhile, "over the first four months, major copper refineries all showed an increase in output, and downstream industries have almost put their full capacity into operation," Li said. She said China this year would produce 3.95 million tons of refined copper, up 6 percent over 2008. In addition, there will also be large increases in refined copper import. Xiao Zheng, an analyst at Ping An Securities, predicted that in the second half this year, the overall economic recovery would definitely help revive the non-ferrous metals and gold industries. "This is especially the case for copper and gold. Copper prices surged the most this year while gold prices maintained its historic high," Xiao said. Gold surged above $900 per ounce this year, and experts expect that prices would climb to $1,000 per ounce within the year. (For more biz stories, please visit Industries)

|

|||||