|

BIZCHINA> Top Biz News

|

|

Corrections will not derail bull run in equities, says S&P

By Zhou Yan (China Daily)

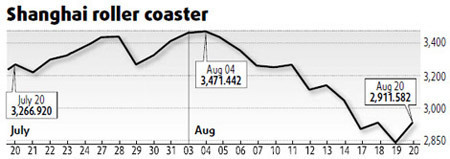

Updated: 2009-08-21 08:05  The recent plunge in Chinese shares is part of a temporary correction that will not last long and would be offset by the country's strong economic growth with the appetite for equities still strong, said Lorraine Tan, vice-president, Standard & Poor's (S&P) Asia equity research. The major index snapped its persistent bull run for seven straight months on Aug 4, and tumbled cumulatively by 20 percent in two weeks until yesterday when it recovered by 4.52 percent to 2911.58 points. "We feel the bear market is over, and this (the two-digit slump) is really just a correction in a new bull market," said Tan in an exclusive interview with China Daily in Shanghai. She said that the leading indicator's hefty drop was not surprising, given the central government's scrutiny on lending that will weigh down funds flowing into equities. "This (index) level of around 2,700 points is quite fair for Shanghai, and we don't really expect it to go down much further from here as there's still a lot of liquidity in the market," Tan said, but admitted that another 5-percent drop to erase the huge gains in July is possible.

S&P lowered its outlook on China's stock market to "neutral" at the end of July, after an "overweight" stance for most of the second quarter. "If the market corrects itself and consolidates further, we think it will present buying opportunities again. We expect the major index to hover around 3,300 by the end of this year, " Tan said. The central bank may be mopping up excess liquidity and urging banks to slow lending, but it still has no pressure to raise interest rates as global consumption demand recovery continues to be slow, Tan said. (For more biz stories, please visit Industries)

|

|||||