|

BIZCHINA> Top Biz News

|

|

Stocks rise, led by metal producers

(China Daily/Agencies)

Updated: 2009-08-25 08:07

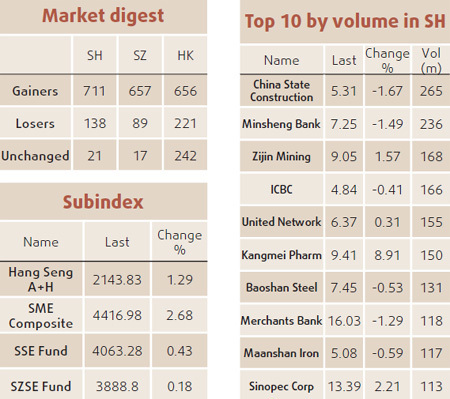

Chinese stocks rose for a third day, led by metal producers, after copper jumped the most in 11 weeks. China Petroleum & Chemical Corp also gained after it reported a surge in profits. The Shanghai Composite Index rose 32.66, or 1.1 percent, to 2993.43 at the close after changing direction at least four times. It has dropped 12 percent this month, the world's second-worst performer ahead of Nigeria, amid speculation economic growth will falter and the government will curb new lending that rose to a record in the first half of the year. "I don't think the reining in will be too aggressive given that the recovery is still on a very uncertain footing," said Nicholas Yeo, China equities head at Aberdeen Asset Management Plc. "There will be more stringent checks on where the loans are going rather than a general reining in of credit." The CSI 300 Index added 0.8 percent to 3229.60. Jiangxi Copper, China's biggest producer of the metal, climbed 6.9 percent to 39.43 yuan. Tongling Nonferrous Metals, the No 2, advanced 5.3 percent to 18.99 yuan. China Petroleum, Asia's largest oil refiner, also known as Sinopec, added 2.2 percent to 13.39 yuan after saying it plans "rapid" overseas expansion to secure supplies as the nation's economic recovery spurs fuel demand.

PetroChina Co, the nation's biggest oil producer, advanced 1.7 percent to 14.20 yuan. Offshore Oil Engineering Co, a unit of the country's third-largest oil producer, rose 2 percent to 11.14 yuan. The Shanghai Composite Index may rise to 3,800 by Dec 31 as earnings rebound and the government maintains bank lending, Lan Xue, Citigroup Inc's Hong Kong-based head of China research, said in an email Aug 21. "We have been advising clients to slowly build some positions in banks, consumer and insurance firms during the downturn," Xue said. Economic data will be "sequentially better month over month" and many companies will beat analysts' estimates and give "strong guidance" for the second half and next year, Xue said. Hang Seng up Hong Kong stocks rose, with the benchmark index rebounding from the worst week since June, after China Resources Power Holdings Co and China Construction Bank Corp reported better-than-estimated profit. The Hang Seng Index rose 1.7 percent to close at 20535.94, after posting a 3.3 percent drop last week, its worst weekly performance since the five days through June 19. The Hang Seng China Enterprises Index, which tracks Hong Kong-listed shares of mainland companies, climbed 2.1 percent to 11703.49.

(For more biz stories, please visit Industries)

|

|||||