|

BIZCHINA> Top Biz News

|

|

Stocks edge up led by developers, airlines

(China Daily/Agencies)

Updated: 2009-08-27 08:01

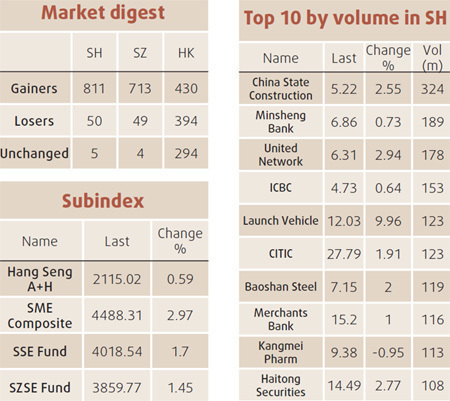

Chinese stocks advanced after Air China Ltd, Poly Real Estate Group Co and China Life Insurance Co reported higher first-half profits, while rising food prices spurred gains by agricultural companies. Air China, the nation's biggest international carrier, surged the 10 percent daily limit and Poly Real Estate added 2.2 percent. China Life gained 1.1 percent. Animal-feed producer Shanghai Dajiang (Group) Stock Co jumped 10 percent as a drought pushed prices of pork, corn and soybeans higher. The Shanghai Composite Index rose 51.79 points, or 1.8 percent, to 2,967.60 at the close. The gauge is down 13 percent this month, the world's worst performer, amid speculation the government will curb lending that rose to a record in the first half. The CSI 300 Index advanced 2 percent to 3,172.39. "Economic and corporate fundamentals are improving and that will help the market to stand firmly above 3,000 points this year," said Larry Wan, Shanghai-based deputy chief investment officer at KBC-Goldstate Fund Management Co, which oversees about $583 million in assets. "The market just needs some time to digest the fallout of the previous sell-off before another rally starts." Hang Seng up Hong Kong's benchmark stock index rose, led by financial shares, after China Life Insurance Co reported higher profit, and Credit Suisse Group AG lifted its rating on Bank of East Asia Ltd.

"Year-to-date earnings in Hong Kong and US companies have generated positive earnings surprise, so based on this and improving GDP, chances are that markets will go up in these two quarters," said Danny Yan, a portfolio manager at Taifook Asset Management Ltd in Hong Kong, which oversees about $400 million. The Hang Seng Index rose 0.1 percent to 20,456. Sixteen stocks on the 42-member measure advanced while 24 dropped. The benchmark gauge has soared 81 percent from a four-month low on March 9, amid speculation stimulus efforts worldwide, including 4 trillion yuanof spending in China, will revive global growth. Shares also rose after a government research agency forecast China's economic growth may exceed 10 percent in the first quarter of next year on a "moderately loose" monetary policy. The policy will stay in place in the short term to ensure a "stable recovery," Ba Shusong, deputy director of the Development Research Center, an affiliate of the State Council, said in an interview with Shanghai Securities News.

(For more biz stories, please visit Industries)

|

|||||