|

BIZCHINA> Top Biz News

|

|

Tech shares lead market recovery

(Agencies)

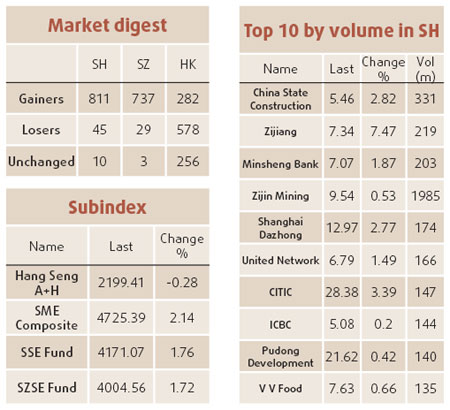

Updated: 2009-09-15 07:57 Chinese stocks rose, driving the benchmark index above 3,000 for the first time in a month, as brokerage and technology shares gained after the government said it will review initial share sales on a new startup board. CITIC Securities Co rose 3.4 percent to 28.38 yuan after the China Securities Regulatory Commission said it would consider proposals on Sept 17 from seven companies to list on the NASDAQ-like board on the Shenzhen bourse aimed at technology companies. Founder Technology Group Corp jumped by the 10 percent limit to 4.65 yuan, the biggest gain in five months, on speculation higher valuations for the startups will boost existing equities in the industry.

The Shanghai Composite Index climbed 36.95, or 1.2 percent, to 3,026.74 at the close, the highest since Aug 14. It rose 4.5 percent last week after the statistics bureau said industrial production and investment growth expanded, and August bank lending unexpectedly accelerated. The CSI 300 Index, measuring the Shanghai and Shenzhen bourses, added 1.7 percent to 3,293.39. A measure tracking technology stocks jumped 4.4 percent yesterday, the most among the 10 industry groups on the CSI 300 Index. The Shanghai index may rise to as much as 3,600 by the end of the year, as private consumption and investment boost demand for health-care services and real estate, said Liu Hong, a Shanghai-based fund manager at Fortis Haitong Investment Management Co. Giti Tire slid 4.9 percent to 7.12 yuan. Guizhou Tire Co slumped 6.7 percent to 14.95 yuan. Chinese tire makers were downgraded to "neutral" from "overweight" at Shenyin & Wanguo Securities Co. Hang Seng slumps Hong Kong stocks fell, led by commodity and banking stocks, as metal and oil prices dropped and economist Joseph Stiglitz said the world has failed to fix the underlying problems of the financial system. The Hang Seng Index declined 1.1 percent to 20,932.2 at the close. The gauge has risen 85 percent from a four-month low on March 9, amid speculation stimulus efforts worldwide will revive global growth. Shares on the benchmark index were valued at 16.9 times estimated earnings, up from 10.6 times at the start of the year. The Hang Seng China Enterprises Index, which tracks H shares of mainland companies, lost 0.9 percent to 12,157.09.

(For more biz stories, please visit Industries)

|

|||||||