|

BIZCHINA> Top Biz News

|

|

Shanghai copper firms up

(China Daily/Agencies)

Updated: 2009-09-18 08:40

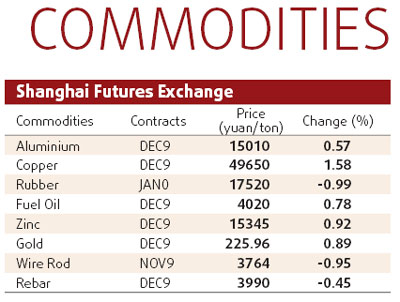

Shanghai copper rose 1.8 percent yesterday, and London futures extended the previous session's rally buoyed by a weak dollar and rising equity markets after more positive US manufacturing data. US industrial production rose for a second consecutive month in August and consumer prices also rose more than expected but inflation risks in the economy remain low, sending the dollar to one-year lows against the euro and a basket of currencies. "Our economists expect further recovery in industrial production in the United States for the rest of the year," Barclays Capital Yingxi Yu said.

Three-month copper on the London Metal Exchange rose $19.25 to $6,434.25 a ton in morning trade, having earlier touched $6,470 around its highest in a week. In Shanghai the benchmark third month contract closed up 880 yuan ($129) at 49,650 yuan ($7,273), but Shanghai's rally has lagged London recently, evidenced by the widening discount for Shanghai metal - above 1,700 yuan - versus the LME when accounting for China's 17 percent VAT. Aluminum rose $18 to $1,945. Earlier prices rallied to $1,957 their highest since Aug 24, despite big deliveries in the few days that have pushed LME stockpiles to a fresh record high of 4.629 million tons. A dealer in Sydney described aluminum's 5 percent rally on Wednesday as "remarkable" given the mountain of metal in LME warehouses. "What puzzles me more is that people are expressing concerns about 'high levels of copper stocks' and 'China's slowing imports', but any way you slice it stockpiles are very low given we are coming through the worst recession since the 1930s," he said. Since early 1999, LME copper stockpiles have averaged 405,000 tons, while China's copper imports, though down 20 percent in August at just over 325,000 tons, were up 83 percent from August 2008. (For more biz stories, please visit Industries)

|

|||||||