|

BIZCHINA> Top Biz News

|

|

Bearish sentiments uppermost

By Liu Yiyu and Bi Xiaoning (China Daily)

Updated: 2009-10-09 08:15

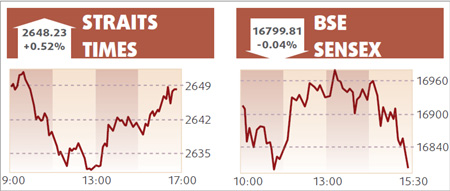

Bearish sentiments are likely to hover over China's post-holiday stock market as market liquidity again concerns Chinese investors. According to an online survey conducted by Sina.com, one of the largest portal websites in the country, more than 50 percent of netizens said the stock market would probably maintain the downward momentum after the National Day holiday. The Shanghai index fell 4.2 percent in the week prior to the holiday, the most in six weeks, as commodity prices slumped and investors speculated rising stock supply would divert funds from existing equities. The gauge was down 6.9 percent the third quarter, the worst performance by a major global benchmark index, on concern a slump in new lending might derail the economic rebound.

According to the survey, the unlocked binge of non-tradable shares in October is the top concern for investors, as the unprecedented climax for unlocked non-tradable shares would show up this month. Statistics from Chinese financial data provider Wind Info showed that a total of about 2 trillion yuan of non-tradable shares will be unlocked in October, accounting for 20 percent of the total market value. In addition, investors' confidence and economic indicators in the third quarter are also among the top factors that concern investors most. The consumer price index for September, a major inflation gauge, is to be released soon and third quarter earnings reports are slated to come out later this month. The to-be-launched growth enterprise board (GEB) and the performance of overseas markets also worried many investors, the survey said. The NASDAQ-style board could also divert investors' attention, although it is not a major threat to the main boards because of the limited funds it could freeze. Industry analysts also said that a host of new listings on the main boards and several additional share placements that could raise chunky funds are also likely to take place in the fourth quarter, putting pressure on market liquidity. Despite all the concerns, the survey also revealed that about 44 percent of investors believe the market will embrace a rally after the national holiday. "I would increase shareholdings as opportunities may emerge when the third quarter earnings prove encouraging," an experienced retail investor surnamed Zheng said. (For more biz stories, please visit Industries)

|