|

BIZCHINA> Top Biz News

|

|

Mainland equities edge up led by renewable energy shares

By Li Xiang (China Daily)

Updated: 2009-11-17 07:59 Chinese shares advanced to a three-month high yesterday led by gains in the renewable energy sector amid expectations that US President Barack Obama's visit may boost the energy cooperation between the two countries. The benchmark Shanghai Composite Index climbed 2.74 percent to close at 3,275.05 points. The Shenzhen Component Index rose 2.5 percent to 1,181.63 points. The trading turnover for the two exchanges rose to 372.3 billion yuan from last Friday's 274.8 billion yuan. Renewable energy shares were in the limelight yesterday. Zhejiang Feida Environmental Science & Technology surged nearly 10 percent to 15.9 yuan, while Shanxi Lu'an Environmental Energy Development climbed 10 percent to 50.64 yuan. Obama will meet with Chinese President Hu Jintao today for talks that are expected to include climate change, new energy cooperation, trade relations and the yuan appreciation. Analysts pointed out that Obama's trip has stimulated significant capital flows to the new energy sector and the uptrend is likely to continue in the coming weeks.

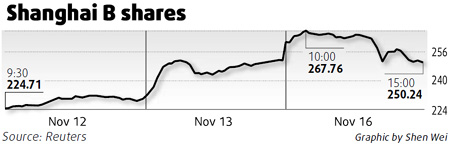

China is moving toward setting its carbon intensity target, which aims at a 40 to 45 percent reduction in carbon emissions by 2020. Dong said he remained optimistic about the uptrend in the market and said it would continue through the year and extend to the first quarter of next year. However, China's foreign currency-denominated B-share markets declined slightly after a strong surge in the past week. The US dollar-denominated B shares at the Shanghai Stock Exchange fell 0.4 percent to 250.24 points while the Hong Kong dollar-denominated B shares on the Shenzhen bourse fell 0.2 percent to 624.17 points. China's B-share market witnessed a strong rally on Friday, gaining 9.42 percent to reach an 18-month high amid speculations of yuan appreciation and a possible merger with the planned international board. Analysts said yesterday's small correction was in response to the recent sharp surges but maintained that B shares remain valuable for mid- and long-term investment given their cheaper price than their counterparts in the A-share market.

(For more biz stories, please visit Industries)

|