Money

Exchange rate hits a 5-year record

By Xin Zhiming (China Daily)

Updated: 2010-07-03 09:24

|

Large Medium Small |

Strong rise of yuan could be temporary: Analysts

Beijing - China's central bank set the yuan's reference central parity rate on Friday to its highest level against the dollar since 2005's revaluation, despite growing concerns about the economic slow-down in China and the rest of the world.

But analysts said the strong rise of the yuan could be temporary because it is a result of the recent weakening of the dollar and strengthening of the euro.

"Once the dollar weakening stops, the yuan could weaken again," said Liu Dongliang, chief currency analyst at China Merchants Bank.

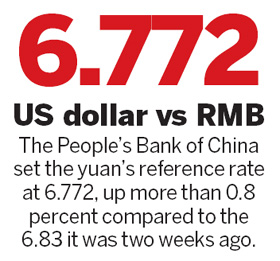

The People's Bank of China set the yuan's reference rate at 6.772, up more than 0.8 percent compared to the 6.83 it was two weeks ago when the authorities announced the yuan would be made more flexible.

In market trading, the yuan rose as far as 6.7808 against the dollar on Thursday, a whisker from Wednesday's peak of 6.7801, the highest since its July 2005 revaluation.

Yuan forwards completed a fourth weekly gain as the euro rallied against the dollar following Spain's successful sale of bonds at auction on Thursday.

Twelve-month non-deliverable forwards jumped 0.2 percent to 6.6690 per dollar as of 5:37 pm in Hong Kong and strengthened 0.14 percent during the week. The performance reflects bets that the yuan will appreciate 1.5 percent in one year.

"The rise of the yuan against the dollar is not surprising," said Liu.

He explained that it was a "technical" appreciation because of the weakening dollar and rising euro.

"It's not strong enough to invite the central bank's intervention."

According to analysts, fluctuations in the yuan are closely related to major currencies, such as the dollar and euro, and China's currency can move because of the volatile international economy.

| ||||

"There will not be drastic changes in the value of the yuan," he said, explaining that both the Chinese and global economy will stabilize in the second half of the year.

Overall, the global economic situation will not change much, with some countries recording more solid recoveries and others recovering slowly, he said.

The global stock markets have fared poorly during the past week, which reflected concern about the economic slow-down in China and the rest of the world, with China's benchmark Shanghai Composite Index dropping to a 15-month intraday low in afternoon trading on Friday.

The index shed 6.7 percent during the week, its biggest weekly loss since March 2009.

"The stock markets sometimes simply over-react," said He.

Wang Tao, head of China Economic Research at UBS Securities, was confident the Chinese economy will not suffer a "hard-landing".

"The short answer is no," she said in a research note.

UBS Securities maintained its GDP growth forecast for China for 2010 and 2011 at 10 percent and 8.7 percent, respectively.

Reuters and Bloomberg contributed to the story.