InfoGraphic

NBS ups 2009 GDP total, growth rate

By Xin Zhiming and Wang Xiaotian (China Daily)

Updated: 2010-07-03 09:49

|

Large Medium Small |

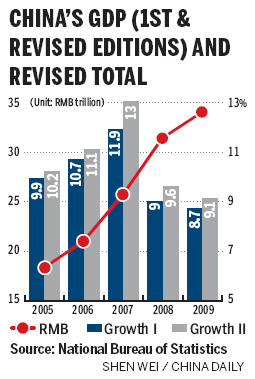

BEIJING - The National Bureau of Statistics (NBS) revised China's 2009 gross domestic product (GDP) figure from 33.5 trillion yuan ($4.95 trillion) to 34 trillion yuan, and revised the nation's annualized growth rate from 8.7 percent to 9.1 percent.

Publishing different editions of the national GDP record is an established practice by many governments around the world, according to a statement posted on the bureau's website on Friday.

Beginning in 2003, the bureau, China's statistical authority, adopted the system of double-checking the GDP total, often released in the middle of the year.

The latest revision is not expected to affect economists' expectations of China's GDP growth in the current year.

Lu Zhengwei, chief economist of Industrial Bank, told China Daily that he still maintains his earlier forecast that the nation will achieve around 10 percent growth in its GDP in 2010 - even though the base figure is somewhat larger with the bureau's latest revision.

Zheng Chaoyu, a professor of economics at Renmin University of China, said that in the past few years every annual GDP revision has resulted in a rise in the growth rate. One explanation could be that China was still building up more manufacturing capacity than it truly needed.

In contrast, a report from the Bank of Communications paints a gloomier picture. It is more likely, it said, that there would be a more marked decline in GDP growth in the second quarter, from 11.9 percent in the first quarter to only 10.2 percent year-on-year.

The benefit from a slowdown in growth, as most financial analysts seem to agree, is that there would not be the necessity for more rises in the interest rate in the second half of the year, so that companies would keep generating GDP and job opportunities on their relatively easy access to banks' credit.

| ||||

In the meantime, also on Friday, China's foreign exchange authorities announced that, as of the end of March, the nation's foreign debt was higher than $443.2 billion, up from $428.7 billion at the end of last year.

The State Administration of Foreign Exchange (SAFE) said the country's short-term foreign debt, which analysts say could include inflows of capital from people speculating on the yuan's appreciation, rose to almost $260 billion at the end of March, accounting for 60.48 percent of the overall.

However, SAFE officials said China's foreign debt servicing ratio, which stood at 2.87 percent in 2009, and the ratio of its short-term foreign debt to GDP, which is less than 11 percent, are both below the internationally accepted warning lines.