InfoGraphic

The rich are getting richer and younger

By Zhou Yan (China Daily)

Updated: 2010-07-15 09:58

|

Large Medium Small |

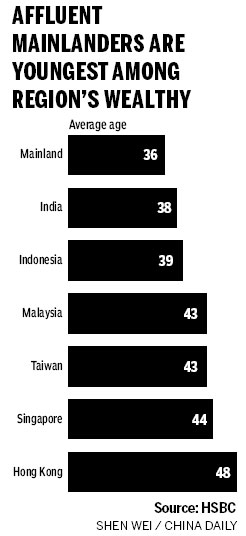

BEIJING - The wealthy are getting younger on the mainland, with an average age of 36, far below the average age of 48 in Hong Kong, according to a HSBC survey released on Tuesday.

The survey, which covered major Asian countries and regions, also showed that the mainland's rich had stronger liquid assets, $126,537 on average, while other emerging economies in Asia reported less, including $87,769 in India and $56,891 in Malaysia.

But the figure remains much lower than Hong Kong and Singapore, which on average hit $301,289 and $183,145 respectively.

The rich in the survey are defined as those who have at least 500,000 yuan ($73,840) in liquid assets.

"The young generation in mainland are joining Asia's newly affluent with growing wealth," said Bonnie Qiu, head of Personal Financial Services at HSBC Bank (China) Company Limited

"We have several friends that made hundreds of thousands of yuan in their 30s it's not difficult to become well-off riding on the booming economy creating plenty of chances to earn money," said Liu Xiaoyan, a 32-year-old financial-software entrepreneur in Shanghai.

She and her husband have bought two houses worth 10 million yuan in the city after diving into the industry three years ago.

HSBC's report showed 69 percent of mainland respondents said that their net assets increased in the past six months.

In addition, the survey said that the mainland's rich put 59 percent of their assets in banks, while the remainder went into investments such as stocks or funds. By comparison, Indonesia's rich put 95 percent of their total assets in banks.

"We only deposit 10 percent of our assets into banks in case of any emergency, given lenders' low interest rates. We'd rather put spare cash into equities and the property market," said Zhang Sa, a 35-year-old property developer in Shanghai, who collectively invested 2 million yuan in stocks.

Indeed, the survey showed 71 percent of the mainland's respondents said they have invested in stocks, compared with Indonesia's 5 percent.

The transaction volume made by the mainland's rich reached $371,885 in the past 12 months, five times higher than Indonesia's $72,105, the survey showed.

Yet, only 18 percent of the mainland's rich said they would increase their stock investments, lower than Hong Kong's 42 percent, after the Shanghai gauge dropped 26.9 percent in the first half.