|

|

|||||||||||

|

|

Major Macro Economic Statistics (y-o-y change if in %)

|

||||||||||

| Growth indexes | Price indexes | ||||||||||

| GDP: +11.1% in H1 | CPI: +2.9% PPI: +6.4% | ||||||||||

| Industrial output: +13.7% | PMI: 52.1 | ||||||||||

| Retail sales: +18.3% | Income: +10.2% | ||||||||||

| Fixed-asset investment: 9.8t yuan in H1 | Housing prices: +11.4% | ||||||||||

| FDI: +39.6% Fiscal Revenue: +14.7% | Foreign trade indexes | ||||||||||

| Power consumption: +14% | Import: +34.1% at $117.4b | ||||||||||

| Financial indexes | Export: +43.9% at $137.4b | ||||||||||

| New loans: +18.2 at $88.9b | Trade balance: $20b | ||||||||||

| M2: +18.5 | |||||||||||

|

CHINA ECONOMY BY NUMBERS (Monthly Issue)

|

|||||||||||

| January Issue | February Issue | ||||||||||

| March Issue | April Issue | ||||||||||

| May Issue | June Issue | ||||||||||

| Data and Graphic | |||||||||||

|

|

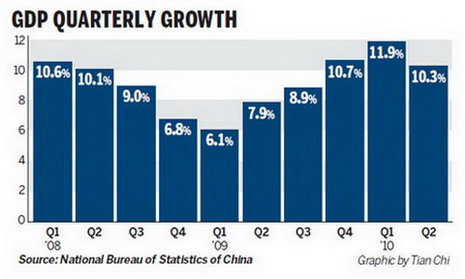

Slowdown 'may add' uncertainty A slowdown in the country's economic growth in the second quarter may add more uncertainty to policymaking, but it will remain stable and new stimulus is unnecessary, Chinese economists have said. China's gross domestic product (GDP) expanded by an impressive 11.1 percent year-on-year in the first six months, the National Bureau of Statistics (NBS) said on July 15, but its growth eased to 10.3 percent in the second quarter from 11.9 percent in the first. [Full Story] |

||||||||||

|

|

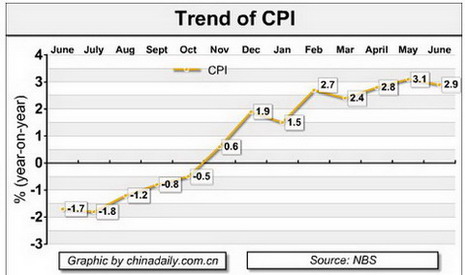

Consumer inflation up slightly in H1 China's consumer inflation will continue to weaken in the second half of this year after easing in June, economists said. The Consumer Price Index (CPI), the major gauge of inflation, grew 2.6 percent in the first half of 2010 over a year ago, the National Bureau of Statistics said on July 15. [Full Story] |

||||||||||

|

|

China's PPI up 6% in H1 China's producer price index (PPI), a major measure of inflation at the wholesale level, increased by 6 percent year-on-year in the first half of this year, the National Bureau of Statistics (NBS) announced July 15. In the second half, the possible overcapacity problems in these industries as a result of falling demand may pull down the PPI. [Full Story] |

||||||||||

|

|

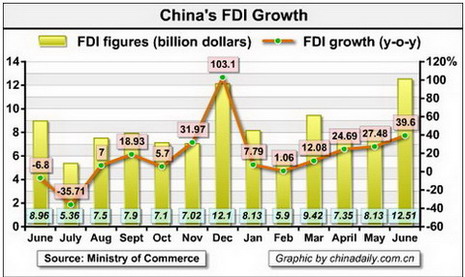

Chinese foreign investment surges despite slowdown China's foreign direct investment (FDI) swelled to $13 billion for the month of June - an increase of nearly 40 percent over the same period last year. The surge, the highest single increase since December 2007, according to industry analysts, reflects how China's investment climate remains highly attractive in the long-term, despite an economic slowdown. This robust FDI growth is also a powerful rebuke to rising concerns among foreign businesses that China's investment environment is worsening, and thus losing ground to its neighbors elsewhere in Asia. [Full Story] |

||||||||||

|

|

China's fixed asset investment up 25% in H1 Total fixed asset investment in China for the first six months rose 25 percent year-on-year to 11.42 trillion yuan ($1.69 trillion), the National Bureau of Statistics (NBS) announced July 15. Urban fixed asset investment increased by 25.5 percent year-on-year to 9.8 trillion yuan and rural fixed assset investment grew 22.1 percent from a year earlier to 1.61 trillion yuan in the first half of this year, the NBS said. In urban fixed-asset investment, total investment in the primary sector (including farming, fishing and forestry) expanded 17.8 percent from a year earlier. [Full Story] |

||||||||||

|

|

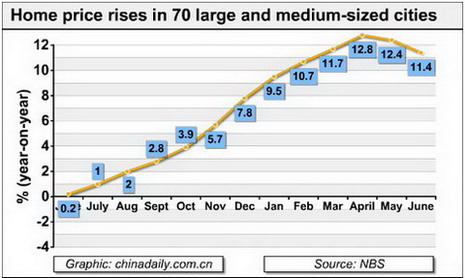

China's housing prices grow slower in June Housing prices in major Chinese cities rose 11.4 percent year-on-year in June, one percentage point lower than the increase in May, the National Bureau of Statistics (NBS) said July 12. This was the second consecutive month that China's property prices grew at a slower pace. Property prices in the 70 large and medium-sized cities grew 12.4 percent in May, 0.4 percentage points lower than that of April. On a monthly basis, June property prices in these cities fell 0.1 percent compared to the month before, the NBS said. [Full Story] |

||||||||||

|

|

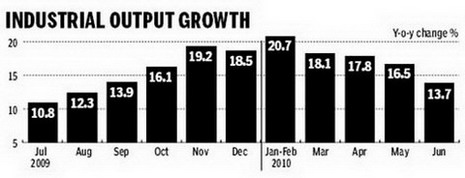

China's industrial output grows 17.6% in H1 China's industrial output grew by 17.6 percent year-on-year in the first half of this year, 10.6 percentage points higher than the same period last year, the National Bureau of Statistics (NBS) announced July 15. Industrial production maintained a relatively fast growth in the first six months, and profits created by the nation's enterprises rose remarkably, Sheng said. [Full Story] |

||||||||||

|

|

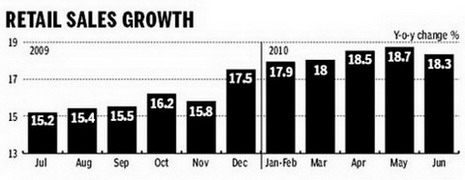

Retail sales of consumer goods hit 7.27t yuan in H1 The total retail sales of consumer goods reached 7.27 trillion yuan ($1.07 trillion) in the first half of this year, a year-on-year growth of 18.2 percent, the National Bureau of Statistics (NBS) announced July 15. The retail sales in cities reached 6.27 trillion yuan, up 18.6 percent from a year ago, and the retail sales in rural areas topped 1 trillion yuan, up 15.6 percent. [Full Story] |

||||||||||

|

|

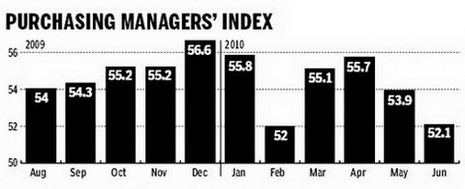

PMI of manufacturing sector falls to 52.1% The Purchasing Managers' Index (PMI) for China's manufacturing sector stood at 52.1 percent in June, down 1.8 percentage points from last month, the China Federation of Logistics and Purchasing said July 1. The PMI includes a package of indices to measure manufacturing sector performance. A reading above 50 percent indicates economic expansion, while that below 50 percent indicates contraction. [Full Story] |

||||||||||

|

|

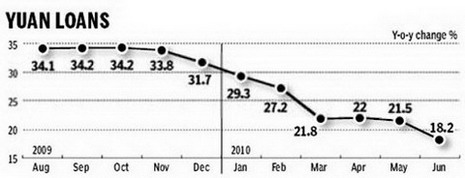

Lending dips as growth slows In June, 603.4 billion yuan ($88.9 billion) in new yuan loans were distributed, according to the People's Bank of China, the nation's central bank, on Sunday. That is considerably less than the May figure of 639.4 billion yuan and 1.53 trillion yuan last June. There were 4.63 trillion yuan in new yuan loans through the first six months, 2.74 trillion yuan less than the same period last year. [Full Story] |

||||||||||

|

|

China's money supply growth slows The balance of broad money supply (M2), which covers cash in circulation and all deposits, was 67.4 trillion yuan ($9.95 trillion) at the end of June, up 18.5 percent year-on-year, the National Bureau of Statistics (NBS) announced July 15. The balance of narrow measure of money supply (M1), cash in circulation plus current corporate deposits, increased 24.6 percent year-on-year to 24.1 trillion yuan by the end of June, the NBS said. [Full Story] |

||||||||||

|

|

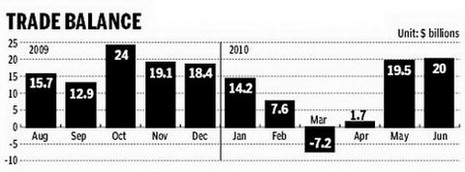

June exports hit record high China's exports for June hit a record high since July 2008 and the trade surplus also surged to the highest this year, but economists insisted such strong momentum cannot be sustained and there is little possibility that the yuan will gain by large margins, as widely expected worldwide. Customs said on its website that China's shipment of exports last month grew by 43.9 percent from the previous year to $137.4 billion and imports rose by 34.1 percent to $117.4 billion, which led to a $20 billion trade surplus, another record high. [Full Story] |

||||||||||

|

|

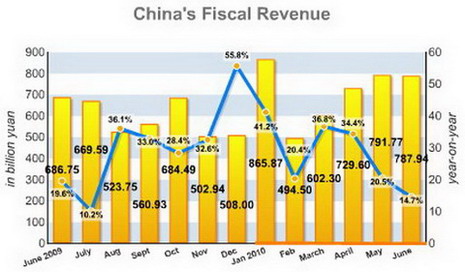

Fiscal revenue up 27.6% in H1 China's fiscal revenue rose 27.6 percent in the first six months from a year earlier to 4.33 trillion yuan ($639.74 billion), said the Ministry of Finance (MOF) July 15. From January to June, tax revenues increased by 30.8 percent from the same period last year to 3.86 trillion yuan, the ministry said in a statement on its official website. Among the total, central fiscal revenue grew by 28.6 percent to stand at 2.28 trillion yuan, while local governments collected 2.06 trillion yuan, up 26.5 percent, according to the statement. [Full Story] |

||||||||||

| Round Table | |||||||||||

|

The slowdown of China's economy in the second quarter was due to the government's "active regulation and control." "China will continue to adopt a pro-active fiscal policy and a moderately loose monetary policy." [Full Story] |

Recent data indicate that interventionist policies of previous months have restored economic growth rates to normal levels. [Full Story] |

||||||||||

|

The slowdown of China's economic growth in the second quarter is normal and it will further slow in the second half of the year. [Full Story] |

|

The Chinese economy seems to have hit its trough as domestic demand drops dramatically. [Full Story] |

|||||||||

|

Investors must learn to use effective currency hedging strategies and identify when the probability of trend change is increasing. [Full Story] |

Finding ways to prevent the government-led economy from overheating has always been the biggest challenge for the country's policymakers. [Full Story] |

||||||||||