World Business

US Fed sees moderate economic growth, unusual uncertainties

(Xinhua)

Updated: 2010-07-22 16:12

|

Large Medium Small |

|

|

|

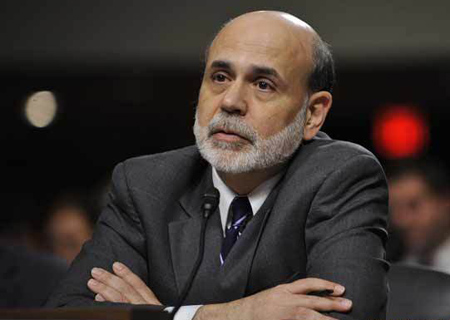

US Federal Reserve Chairman Ben Bernanke testifies before the Senate Banking, Housing and Urban Affairs Committee during a hearing on the Federal Reserve's semiannual monetary policy report to the Congress on Capitol Hill in Washington D.C., capital of the United States, July 21, 2010. [Xinhua] |

WASHINGTON - The Federal Reserve said on Wednesday that the US economy expanded at a moderate pace in the first half of 2010 after picking up in the second half of 2009, but economic outlook remains "unusually uncertain."

After rising at an annual rate of about 4 percent in the second half of last year, US real Gross Domestic Product (GDP) increased at a rate of 2.75 percent in the first quarter of this year, and is expected to strike another moderate gain in the second quarter, the Fed said in its semiannual Monetary Policy Report to Congress.

In the external sector, exports continued to rebound, providing impetus to domestic production, while imports were lifted by the recovery in domestic demand.

However, the report said housing construction remains sluggish amid "weak demand, a large inventory of distressed or vacant houses, and tight credit conditions for builders and some potential buyers."

Federal Reserve Chairman Ben Bernanke described the economic prospect as "unusually uncertain," and promised to take additional steps to bolster recovery if economy worsens.

The fed "continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period," Bernanke said when testifying before the Senate Banking Committee on the latest monetary policy report.

The Fed has maintained the federal funds rate unchanged at a record low of between zero to 0.25 percent since the end of 2008 to prop up the economy.

"Even as the Federal Reserve continues prudent planning for the ultimate withdrawal of extraordinary monetary policy accommodation, we also recognize that the economic outlook remains unusually uncertain," he said.

"We will continue to carefully assess ongoing financial and economic developments, and we remain prepared to take further policy actions as needed to foster a return to full utilization of our nation's productive potential in a context of price stability. "

The report also noted that the country's labor market has shown modest improvement in the first half of this year. On average, private-sector employment rose 100,000 per month over this period, with increases across a wide range of industries.

"Nonetheless, the pace of hiring to date has not been sufficient to bring about a significant reduction in the unemployment rate," it said.

The unemployment rate averaged 9.75 percent in the second quarter, only slightly below its recession high of 10 percent in the fourth quarter of 2009, the report noted, adding that long- term unemployment has continued to worsen.