Cars

Auto rentals accelerate into fast lane

By Li Fangfang (China Daily)

Updated: 2011-01-31 09:33

|

Large Medium Small |

|

|

|

A sedan passes by an auto leasing company in Zhengzhou, Henan province. Traveling in a rented car is becoming increasingly popular in China because of the greater convenience and flexibility it affords. [Photo / China Daily] |

Vehicle leasing drives forward as congestion is tackled but consolidation among firms lies ahead

BEIJING - When Lu Tang phoned a rental company to hire a car 10 days before Spring Festival - something he has done many times in previous years - he was surprised to be told there was nothing suitable available.

"I was told almost all the cars have been booked," said Lu, 29, who works for an insurance company in Beijing. "It's been my custom in recent years to go back to my hometown in Shanxi province with my wife in a rental car."

This year, however, it seems many people had the same idea despite the cost of leasing vehicles doubling and, in some cases, more than tripling.

"It seems that more and more people like me are happy to rent a car during the holidays," said Lu, who is still trying to find a car.

Alongside the fast growth and increasing maturity of the auto market, the auto service industry is also developing quickly and vigorously.

Consumers have latched on to the flexibility and convenience afforded by traveling in a leased vehicle.

"Renting a car can save the hassle of ownership and puts the cost of maintenance on the leasing companies. It also allows the driver to choose different models for different occasions, which is important for me," said Da Wei, an amateur photographer based in Beijing.

Increasing demand, improved living standards and new policies curbing private car usage are providing a big boost to China's car rental market.

Moreover, domestic rental companies have realized the potential of this promising business and have begun an aggressive expansion to compete for more market share.

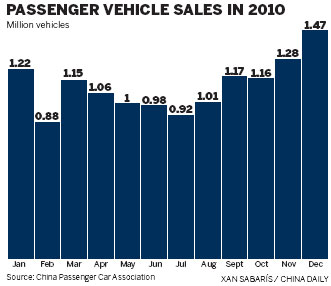

"The rapid growth of passenger vehicle capacity in China over the past five years boosted the development of the local car rental market," said Shen Jun, a partner at consulting firm RolandBerger. "In the next five years, China's car rental market will enter another fast-growing period."

According to a report by RolandBerger, from 2005, China's car rental market maintained a year-on-year growth rate of 30 percent. At present, the 5,000 to 10,000 registered car rental companies around the nation provide 140,000 vehicles.

The report predicted that in the next five years, China's car rental market will grow 25 percent year-on-year, to hit 400,000 vehicles by 2015, providing revenue of 38 billion yuan annually.

Analysts said that the Beijing government's new policy of slashing vehicle purchases by 80 percent this year will be copied by other cities aiming to ease their own serious traffic problems. Add that to the rising cost of driving cars and it's clear the domestic car rental business can only get bigger.

The huge potential and the opportune timing have prompted industry players to launch an aggressive expansion drive over the last year.

On Aug, Qiangsheng Holding Co Ltd said it planned to raise funds to buy assets from its two largest shareholders - Shanghai Qiangsheng Group and Shanghai Jiushi Corporation.

The Shanghai-listed company aimed to sell about 245 million shares in a private placement at 7.03 yuan each, bringing in 1.72 billion yuan.

In return, the two largest shareholders would insert their taxi operations, car rental, auto service and travel businesses into Qiangsheng Holding.

A week later, Beijing-based China Auto Rental Ltd received a 1.2 billion yuan investment from Legend Holdings, parent company of IBM's PC division owner Lenovo Group, to add more cars to its fleet.

Company President Lu Zhengyao said China Auto Rental aimed to expand its fleet from 6,000 units at that time to 10,000 vehicles by the end of 2010, and then 100,000 units in 2015.

The same month, Shanghai-based eHi Car Service signed a definitive investment agreement valued at $70 million with a consortium including Goldman Sachs as the lead investor, and all of eHi's existing shareholders - Qiming Venture Partners, CDH Ventures, Ignition Capital and JAFCO Asia.

Zhang Ruiping, founder, chairman and chief executive officer of eHi, said: "The company will use the fund to further expand our fleet and geographical coverage, provide more value-added services and pioneer a greener lifestyle through car sharing for our customers, promote fleet outsourcing to more corporate clients, and maintain its leading position in China's car rental market."

Last November, Japanese automaker Mitsubishi reached an agreement with Zhejiang Cheyou Auto Leasing Co Ltd to invest $20 million to form a joint venture called Haina International Auto Leasing Co Ltd. Cheyou expected the venture will be listed in the United States before 2013.

However, compared with the mature car rental market in the West, which is dominated by international car rental conglomerates including Avis and Hertz, China's car rental industry is fragmented and disordered.

Statistics show that by the end of 2009, 50 percent of China's registered 5,000 to 10,000 car rental companies were located in the four major cities of Beijing, Shanghai, Guangzhou and Shenzhen.

Analysts said that China's car rental industry requires several big and integrated leasing companies to lead future development.

Shen of RolandBerger predicted that in the next five years, China will boost restructuring and merging within the industry, providing opportunities for capable players to aggressively expand.

However, Zhang of eHi said that he hopes the Chinese government can soon draw up national regulations and standards for the sector to promote its healthy development.

"The establishment of credit systems is also vital for the development of the car rental market in China," said Zhang.

According to a survey conducted by consulting firm Sinotrust in December, because the majority of users rent cars for their private needs, they are highly price sensitive. However, it also found that the condition of leased cars, the reputation and credibility of the leasing company and the convenience in handling pick-up and drop-off procedures were also factors considered by consumers.

"The Chinese are indeed price sensitive. But for a service industry, in contrast with a manufacturing industry, a price war would not be sustainable," said Zhang.

Established in 2006, eHi has become the fastest-growing car leasing company in China, with yearly revenues of more than 200 million yuan.

"The key factor behind our rapid development is a constant focus on service and catering for customers' requirements," said Zhang, who makes full use of the Internet and management software to operate his leasing business.

This month, with the long term in view, Zhang started a series of branding activities for eHi, the first in the industry. One of them included inviting actress Yao Chen, whose micro blog on sina.com.cn has a huge following, to be eHi's brand ambassador, targeting younger customers.

"We hope that renting a car can be a new lifestyle in China, as well an efficient solution to solving traffic congestion in big cities," said Zhang.

| 分享按钮 |