Economy

Fashion, but at a bargain price

By Bao Chang (China Daily)

Updated: 2011-02-21 10:42

|

Large Medium Small |

Wan Wenying, the former general manager of Yansha Youyi, who introduced the outlet business mode to China, said in the domestic market, outlet malls selling big-name brands tended not to offer discounted prices, while those that did were not attractive enough for the high-end manufacturers.

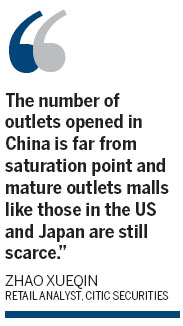

"Lack of ability in attracting top brands is the biggest challenge facing those mall operators," Zhao said.

In order to ensure a plentiful variety of goods for sale and low prices, Outlets (China) is trying to purchase products from the brands' parent companies abroad instead of their sales agencies in China.

"To compete against other rivals in the market, we will provide customers with hundreds of brands priced at a 60 to 70 percent discount, the company said.

Hangzhou Xiasha Outlets, backed by Shanghai Bailian Group, also purchased goods from the countries of origin. Last year, Burberry provided more than 2,000 new collections at a discounted price when the malls opened.

"Many people can open outlets, but the low price is where there is the biggest competitiveness," Sina.com quoted Liu Xiaoguang, the director of Outlets (China), as saying.

Outlet operators are also stepping up plans to enter China's second- and third-tier cities. European retailer Retail Detail Merchandising (RDM) announced in January the company will invest 6 billion yuan to establish five outlet malls in China over the next five years.

Outlet operators are also stepping up plans to enter China's second- and third-tier cities. European retailer Retail Detail Merchandising (RDM) announced in January the company will invest 6 billion yuan to establish five outlet malls in China over the next five years.

The company's first mall will be opened in Tianjin city this May. Ivano Poma, managing director of RDM's Asia-Pacific branch, said he expects the sales of the new mall to reach 1 billion yuan this year.

According to Linkshop.com, a Beijing retail market research website, Shanghai Bailian plans to open two new outlet malls in Wuxi and Wuhan cities in the second half of this year.

Last year, several outlet malls were opened in China's Hangzhou, Changsha, Zhengzhou and Ningbo cities.

According to CITIC Securities, a city with 300,000 people with purchasing power can sustain an outlet mall. According to the National Development and Reform Commission, at present, there are 391 cities with populations exceeding 200,000 purchasing-empowered citizens and 122 cities with populations of more than 1 million with buying power.

"The number of outlets opened in China is far from saturation point and mature outlet malls like those in the US and Japan are still scarce," said Zhao.

In the US, there are 206 outlet malls covering more than 10,000 square meters each. In China the number is less than 40.

"The number of outlet malls in China will surpass that of the US market soon because China's luxury goods market is growing at 10 percent every year," Zhao said.

China's Financial Times website reported that China now boasts 1,900 yuan billionaires - a third more than in 2009, and a stark jump from 24 in 2008 - and 875,000 yuan millionaires.

The Shanghai-based Hurun Report, which analyses China's wealthy, has published the findings of a survey of 401 Chinese dollar millionaires.

The average Chinese millionaire spends $380,000 a year and favors a handful of top luxury brands which Hurun ranked in the following order: Louis Vuitton, Hermes, Chanel, Cartier and Gucci. According to the survey, there is an emerging Chinese middle class with an interest in luxury goods but who possess a greater enthusiasm in shopping at outlet malls.

McKinsey and Company management consultants expects the middle class to expand from its current 29 percent of China's 190 million urban households to 75 per cent of 372 million urban households in 2025.

"The upper middle classes are the ones who are ready to buy a small apartment, who own a car, who think about leisure activities more," the Financial Times website quoted Max Magni, head of the consumer products practice in McKinsey Greater China, as saying.

The lack of mature outlet malls in China is not stifling the enthusiasm of the Chinese for shopping. The emerging middle class and rich people also like to visit outlet malls abroad.

The Financial Times website reported Chinese shoppers appear to be going in their droves to Japanese outlet malls.

|

|||

For some, the growing existence of Chinese tourists is even helping malls to expand, the paper reported.

"There's no way we can ignore Chinese tourists, whose numbers are expected to further increase," premium outlet operator Chelsea Japan told Asahi.

The 200-store Gotemba Premium Outlets is one of Chinese consumers' favorite shopping centers in Japan. It is located in Shizuoka prefecture, which is close to Tokyo and also to some of Japan's most famous tourist attractions such as Mount Fuji, the Izu Peninsula and Hakone, known for its beautiful mountains and hot springs.

According to Asahi, the outlet has doubled its floor space since opening in 2000 and Chinese-speaking staff have been recruited to help shoppers from China.

Asahi said there were plenty of Chinese shoppers running up to the new year.

Meanwhile, Mitsubishi Estate plans to open an outlet mall close to Tokyo's Narita Airport by 2013, specifically targeting Chinese customers, the paper reported.

Developers are not only restricting their plans to Japan. Mitsui Fudosan will open its first outlet overseas in Ningbo, East China's Zhejiang province, this summer.

| 分享按钮 |