Biz Unusual

Stock that paints a pretty and profitable picture for investors

By Li Jing (China Daily)

Updated: 2011-04-08 15:41

|

Large Medium Small |

|

|

|

Top: The website of Tianjin Cultural Artwork Exchange, which is believed to be the first of its kind in the country. Above: A scroll painting of a military parade from the Qing Dynasty (1644-1911) holds the record for a Chinese artwork sold at auction in France. The 24-meter scroll sold for 22.1 million euros ($31 million) in Toulouse on March 23. [Photo / AP] |

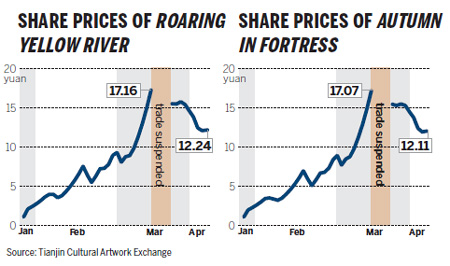

What's happening to the art stocks traded at TCAE validates such worries. The dramatic swings of the share prices have led to questions whether the trading is manipulated or even a scam.

The price of the two paintings rocketed more than tenfold within six weeks after the shares were issued. The exchange revised its trading rules several times to curb the unbridled investment.

TCAE issued a notice on March 7 saying it would lower daily price limits from 15 percent to 10 percent - meaning that the daily highs and lows could not exceed 10 percent of the opening price - but did not give a specific date on which it would implement the new rule.

Three days later, it raised the threshold for investors to open a trading account from 50,000 yuan to 500,000 yuan.

Neither move seemed effective. Trading of the two paintings was suspended on March 17 following an order from "Tianjin municipal regulatory bodies, in order to reduce the risks and protect the investors' interests", TCAE said on its website.

The exchange declined to say who its supervisor is and turned down all interview requests by news media. Nor does it accept on-the-spot inquiries about trading procedures or the management structure.

When trading of the two paintings resumed on March 24, prices started to drop.

Meanwhile, seven more paintings by Bai were listed on the platform, and all recorded a significant increase in price.

Profit vs. art

Some art critics said that speculation on such obscure paintings would further disturb the already volatile art market in China.

Zhang Zhongyi, vice secretary-general to China Association of Collectors, was quoted by Century Weekly magazine as saying, "Bai's works are not particularly popular at auction houses. The speculation at TCAE has led to severe overvaluation of his paintings. The bubble is already there."

A mature and credible valuation system is still absent, making investors more vulnerable to the potential risks. But several investors admitted they don't really care about the artistic value of Bai's paintings as long as they can profit from the secondary market.

A similar platform in France, the Art Exchange, which opened in January, was the object of remarks more blunt than Zhang's, reported Art+Auction, a New York-based magazine that focuses on investment in art and antiques.

"It's a dumb idea," the magazine quoted New York dealer Christophe van de Weghe as saying. "Their target is people who don't know anything about art and who think of the art world as fancy, exotic and fun."

Sergey Skaterschikov, chief executive officer of Skate's Art Market Research, commented on the potential for manipulation: "There's enough fraud and abuse in the art market already, and it would be very easy to exploit art-backed securities."

Bai's paintings are still being traded in shares at TCAE. But the exchange quit opening new accounts on March 28, without stating the reason or when the service would resume. The fate of Bai's paintings - and that of the investors - is still pending.

A new wave?

Emergence of such art exchanges points to a renewed boom in China's art market. In 2007, a wave of record auction prices for paintings by contemporary Chinese artists flowed around the globe, making some of them best-sellers worldwide almost overnight. Then the global financial crisis hit and, in 2008, the art bubble burst.

China overtook Britain as the world's second biggest market for art and antiques last year, said a report in March from The European Fine Art Fair.

A record auction price for a Chinese contemporary artwork - HK$79.06 million ($54.8 million) - was set on Sunday at Sotheby's in Hong Kong. Zhang Xiaogang's 1988 work, Forever Lasting Love, a triptych oil painting, shows half-naked figures in an arid landscape surrounded by symbols.

The Chinese government has identified the cultural industries as a new driver for the country's economic growth. The State Council approved the Plan to Adjust and Reinvigorate the Culture Industry in September 2009, making it a national strategic industry.

In the country's 12th Five-Year Plan (2011-2015), the top leaders have set a target to raise the industry's percentage of national economic growth from about 2.5 percent to 5 or 6 percent.

Some experts warn that the push and investment by the government will not be enough to bolster the healthy development of the industries.

Lu Peng, an associate professor at China Academy of Art, said lessons should be learned from the turmoil related to TCAE. "The incident actually reflects that the public lacks the most basic common knowledge of artworks," Lu wrote on his micro blog. "The problem is those investors can't really judge the value. It is not a bad thing if we can take this chance to promote art education among the public."

| 分享按钮 |