|

|

|||

|

|

Major Macro Economic Statistics |

||

| Growth indexes | Price indexes | ||

|

GDP (H1): +9.6% |

CPI: +6.4% | ||

|

Industrial output: +15.1% |

PPI: +7.1% | ||

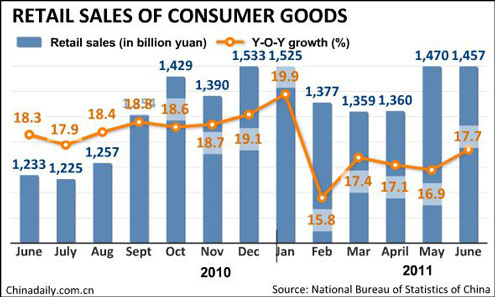

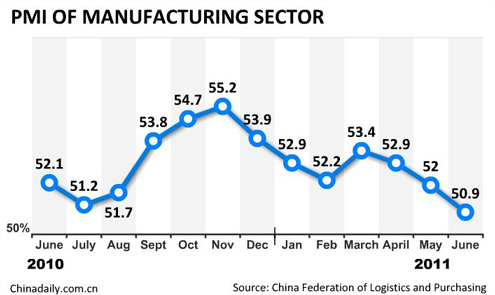

| Retail sales: +17.7% | PMI of manufacturing: 50.9 | ||

|

Urban fixed-asset investment: +25.6% |

Foreign trade indexes | ||

| Financial indexes | Import: $139.7b | ||

| New loans: 633.9b yuan | Export: $161.9b | ||

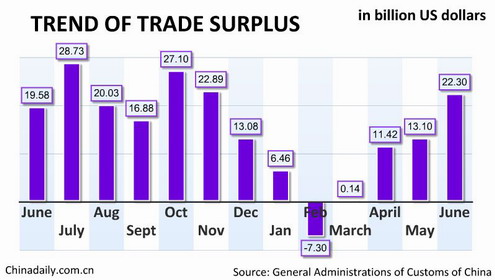

| M2: +15.9% | Trade surplus: $22.3 b | ||

| Foreign reserves: $3.2 t | |||

|

Data and Graphic |

|||

|

|

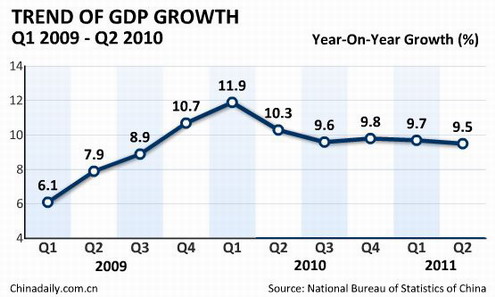

China's GDP up 9.6% in H1

China's economy expanded by 9.6 percent year-on-year in the first half of 2011, the National Bureau of Statistics (NBS) said Wednesday. Gross domestic product (GDP) rose by 9.5 percent in the second quarter, tapering off slightly from the 9.7-percent growth posted in the first quarter, NBS spokesman Sheng Laiyun told a press conference. |

||

|

China's CPI hits 3-yr high of 6.4% in June

China's inflation escalated to the highest level in three years amid lingering pressure, with the consumer price index (CPI), the main gauge of inflation, jumping 6.4 percent year-on-year in June, the National Bureau of Statistics (NBS) said Saturday. The June inflation rate accelerated 0.9 percentage points from May's 5.5 percent which stood at a 34-month high, both far exceeding the government's annual inflation control target of 4 percent. |

||

|

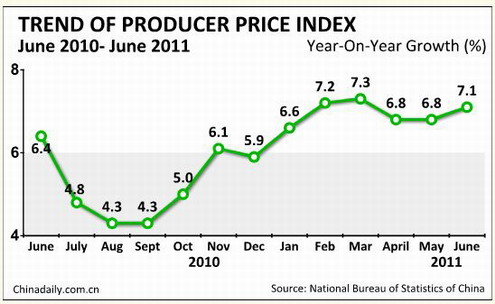

PPI up 7.1% in June

China's Producer Price Index (PPI), a major measure of inflation at the wholesale level, rose 7.1 percent year-on- year, the National Bureau of Statistics (NBS) said Saturday. The PPI growth in June escalated from May's 6.8 percent increase, the NBS said in a statement on its website. On a month-on-month basis, the June PPI was flat from May. |

||

|

|

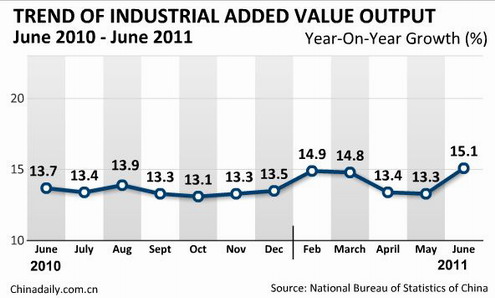

China's industrial output up 14.3% in H1 China's industrial value-added output grew 14.3 percent year-on-year in the first half of this year, the National Bureau of Statistics said Wednesday.

|

||

|

|

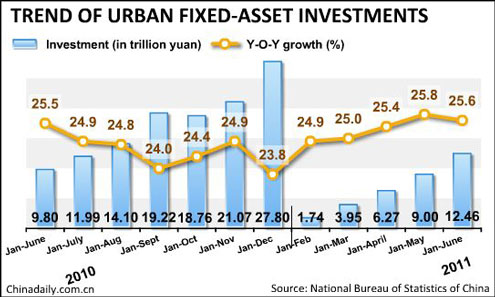

China's fixed asset investment up 25.6% in H1 China's fixed asset investment rose 25.6 percent year-on-year to 12.4567 trillion yuan ($1.925 trillion) in the first half of this year, the National Bureau of Statistics (NBS) announced on Wednesday.

|

||

|

|

China's retail sales up 16.8% in H1 China's retail sales of consumer goods rose 16.8 percent year-on-year in the first half of this year, the National Bureau of Statistics (NBS) announced on Wednesday.

|

||

|

|

Manufacturing production slows in June

China's manufacturing production fell to a 28-month low in June, indicating a sizeable slowdown in economic growth against a recent background of soaring inflation. However, the inflationary pressure is likely to ease in the second half of the year, with both manufacturing input and output prices showing a slower rate of increase, according to a statement on the website of the China Federation of Logistics and Purchasing (CFLP). |

||

|

Import growth lowest in 20 months

The pace of China's import growth in June fell to its lowest level in 20 months as tightening monetary policies kicked in, resulting in the biggest monthly trade surplus this year, official statistics show. Import growth is expected to slow in the coming months, thanks to the broad impact of the tightening measures, before picking up in the last quarter, economists predicted. According to the General Administration of Customs (GAC), imports rose 19.3 percent, from a year earlier, to $139.7 billion, the weakest since November 2009. [Full story] |

||

|

|

Bank lending hits 633.9b yuan in June China's new bank lending rebounded to 633.9 billion yuan ($97.52 billion) in June from May's 551.6 billion yuan, the People's Bank of China said on Tuesday. The June figure was also 20.7 billion yuan more than that of last June, the central bank said.

|

||

|

Comments & Opinion |

|||

|

It seems more evident than ever that the Chinese economy is at a critical crossroads, with inflation soaring to the highest level in three years while other economic indicators point to a slowdown in growth. The latest economic data has created a dilemma for policymakers. They have to maintain sustained growth while taming feverish domestic prices. Inflation, fueled by surging food prices, hit 6.4 percent in June and could run out of control if the central bank loosens its monetary-tightening stance. However, the risk of an economic "hard landing" leaves Beijing with limited room for further policy maneuvering. [Full story] |

|||

|

Curbing soaring prices has become a priority for China. In May the consumer price index (CPI), a measure of inflation, reached 5.5 percent year-on-year, a 34-month high, according to the National Bureau of Statistics. Inflation is the result of the government's loose monetary policy since late 2009 which allowed extra money to flow into the economy, says Liu Lingling, professor of economics at Tsinghua University. The broad currency supply, or M2, in China reached 76.34 trillion yuan ($11.78 trillion) in May. |

|||

|

More tightening needed With the consumer price index (CPI) hitting its highest level in nearly three years in May, policymakers need to put the brake on inflation again. The latest decision by the People's Bank of China to raise the reserve ratio rate to a new high is surely only the start of efforts to absorb excess liquidity. The third hike in interest rates this year should come in weeks, if not days, to prevent inflation from rocketing through the roof. [Full story] |

|||

|

Export engine hums along For those seeking clues on the health of the Chinese economy and global growth prospects, China's latest trade data are not of much help. A trade surplus of $13.1 billion in May can be interpreted as evidence of the cup being half full or half empty. It is higher than that in April and shows that Chinese exporters are faring well. But it is less than expected, underlining a pullback in global demand that bodes ill for export growth. [Full story] |

|||

|

Hard-landing fears misplaced China's economy may be the second largest in the world. But the Chinese economy, as financial markets see it, can still change direction with dizzying speed. A few weeks ago, many commentators seemed to believe that the People's Bank of China, the country's central bank, was reacting too slowly to signs of the economy overheating. Now, after a run of weaker-than-expected data, many are worried that the pace of growth is already in rapid decline. [Full story] |

|||

|

Mid-year slowdown needed Less speedy manufacturing growth is the latest sign that China may be entering a new phrase in its hard fight against soaring inflation. Chinese policymakers should make it clear that they are ready to endure a period of moderate growth long enough for a decisive change in inflationary expectations to take root in this country. [Full story] |

|||

|

|

|||