Firms ponder a return to Libya

Updated: 2011-10-25 10:29

By Chen Keyu (China Daily)

|

|||||||||||

|

The Huawei Technologies Co logo on the company's trade stand at the Mobile World Congress in Barcelona, Spain. Since the escalation of the conflict in Libya that started in February the majority of Chinese companies evacuated their employees from the North African country. But a source in Huawei said they still have workers there. [Photo/Bloomberg] |

Billion dollar contracts signed under Gadhafi regime to be reviewed for corruption by NTC

BEIJING - After the death of ousted leader Muammar Gadhafi in Libya, opinions are divided about the timing for Chinese companies to return to the oil-dependent North African country.

According to a report in People's Daily, China's communications giants Huawei Technologies Co Ltd and ZTE Corp have returned to Libya to play a role in its reconstruction.

Huawei signed a contract worth $10 million with the Libyan International Telecom Co last year over the construction of a 40-kilometer undersea cable set to be completed this year. ZTE has a contract for the maintenance of the 3G network in Libya, one of the largest in the continent. It has been in commercial use since 2006.

A source at Huawei said that the company did not evacuate its workers from Libya, adding that "Huawei might be the only foreign company remaining there", Southern Metropolis Daily reported.

After the outbreak of violence in Libya in February, ZTE evacuated 112 Chinese employees and subcontractors from the country, leaving about 20 local workers to maintain the network. More than 35,000 Chinese people were withdrawn from the country overall.

Southern Metropolis Daily reported future security depends on "political stability, security and the administration of the National Transitional Council (NTC)".

An official from the Arabian Gulf Oil Co (AGOCO), based in Benghazi, said the newly formed government would have some "issues" with China and Russia, according to Reuters.

The remarks were seen as NTC's response to a perceived lack of support from the two countries for the rebels in their opposition to toppled Gadhafi.

In March, China, along with Russia and Brazil, abstained from passing a resolution by the United Nations Security Council that authorized the use of force to impose a no-fly zone in Libya.

But Mei Xinyu, a researcher at the Chinese Academy of International Trade and Economic Cooperation, a think-tank under the Ministry of Commerce (MOC), wrote in an article to the Global Times newspaper that there was no need to worry about investment in Libya after the regime-change because of the "economic inter-dependence between the two countries".

Mei wrote there are higher-level officials who advocate cooperation with China, Russia and Brazil.

Ahmed Jehani, a senior official for reconstruction in the NTC, which is recognized by more than 60 countries, including China, promised to honor all oil and gas contracts signed during the Gadhafi era, including those with Chinese companies, during an interview with Reuters.

Mei also said Libya has no reason to exclude China in reconstruction projects. China can offer quality supplies and construction projects at competitive prices.

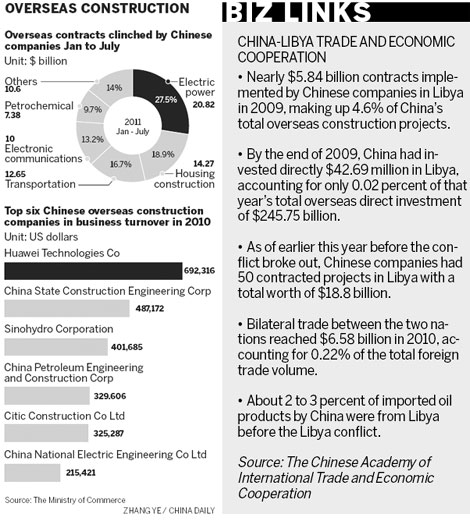

Last year there was bilateral trade volume of $6.58 billion between the two countries. That is just 0.22 percent of China's total trade volume, according to Mei, who said 11 percent of Libya's crude oil was exported to China, accounting for only 2 to 3 percent of China's total oil imports. He added that the conflict had not particularly disrupted import channels of crude oil to China.

In 2009, contracted Chinese projects in Libya totaled $5.84 billion, 4.6 percent of the total overseas contracted projects, which are worth $126.21 billion.

The proportion remains nearly unchanged, said Mei.

By the end of 2009, China invested directly $42.69 million in Libya, accounting for 0.02 percent of that year's total overseas direct investment (ODI) of $245.75 billion.

Earlier this year, before the conflict broke out, Chinese companies had 50 contracted projects in Libya worth a total of $18.8 billion, according to the MOC.

These projects, partly invested by 13 State-owned enterprises, including China Railway Construction Co Ltd, China State Construction Engineering Corporation and China National Petroleum Corporation, range from housing and railway construction to oil and telecommunications.

These projects were suspended after the conflict started. China Railway had three contracted projects worth $4.23 billion suspended with $3.55 billion left uncompleted.

How many suspended contracted projects will be resumed is uncertain. The NTC has said some contracts signed during the Gadhafi-era would be investigated for corruption, which might have an effect on Chinese deals.

Zhang Baoying is the general manager at Beijing HongFu Construction and Engineering Group's branch in Libya. The company's contracted housing projects signed with the former Libyan housing authority are among those suspended. Zhang was quoted by the Daily Economic News as saying that the corruption review would provide excuses for the revoking of some contracts.

Despite the violence in Libya, China's completed turnover in overseas contracted projects surged 11.3 percent year-on-year to $58.9 billion in the January to August period, according to data from the MOC.

Newly contracted projects in the first eight months were worth $84.17 billion, a year-on-year increase of 12.3 percent, compared with $75.77 billion from January to July, a year-on-year rise of 25.2 percent.

From January to July, electric power topped the industry list by attracting $20.82 billion newly-signed contracts, followed by $14.27 billion in housing construction, $12.65 billion in transportation, $10 billion in electronic communications, and $7.38 billion in the petrochemical industry.

Related Stories

China propels Huawei's sales 2011-09-28 13:39

Huawei eyes enterprise deals 2011-09-16 13:31

Jobs' quit will provide more opportunities for ZTE 2011-08-26 10:08

ZTE aims to beat mobile device targets 2011-08-10 10:20

- JP Morgan confident in its China growth

- CNOOC says oil leaks in Bohai Bay sealed

- Tablet to utilize Alibaba OS

- Japanese factory workers strike over wage dispute

- BYD sets up North American headquarters in LA

- Resource tax will not affect oil price

- China to simplify foreign exchange rules

- Home prices decline in suburban areas