|

|

|||

|

Major Economic Statistics |

We sincerely invite you to join in our survey and leave your comments.

|

|

| Price indexes | |||

| CPI:+4.5%; PPI:+0.7% | |||

| PMI of manufacturing:50.5 | |||

| Financial indexes | |||

| New yuan loans: 738b yuan | |||

| M2: +12.4%; FDI: $9.997b | |||

| Foreign trade indexes | |||

| Import: $122.66b; Export: $149.94b | |||

| Trade surplus: $27.28b | Click here to comment | ||

|

Data and Graphic |

|||

|

|

China's CPI rises 4.5% in Jan China's consumer price index (CPI), a main gauge of inflation, rose 4.5 percent year-on-year in January, the National Bureau of Statistics said Thursday. The growth rate was the highest in three months, accelerating from 4.1 percent in December and 4.2 percent in November. On a monthly basis, the country's CPI increased 1.5 percent in January, the NBS said. [Full story]

|

||

|

|

China's PPI up 0.7% in Jan China's Producer Price Index (PPI), a main gauge of inflation at the wholesale level, rose 0.7 percent in January year-on-year, the lowest since December 2009, the National Bureau of Statistics (NBS) said Thursday. The reading eased further from December's 1.7-percent growth, as most of the country's factories suspended production during the Chinese Lunar New Year holiday. [Full story]

|

||

|

|

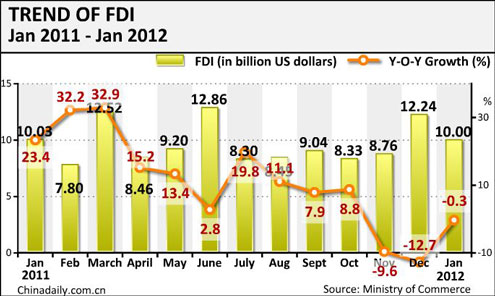

China's FDI falls 0.3% in Jan China made actual use of $9.997 billion of foreign direct investment (FDI) in January, down 0.3 percent year-on-year, the Ministry of Commerce said Thursday. [Full story] |

||

|

|

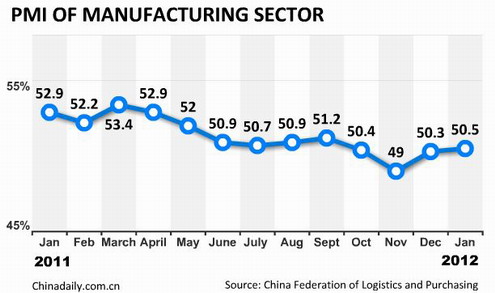

Uptick in official PMI 'signals stabilization' China's manufacturing sector expanded in January, as indicated by a slight rise in the Purchasing Managers' Index (PMI) to 50.5 from 50.3 in December. The rise was a signal that the pace of economic moderation was stabilizing, analysts said, and further easing policies might soon be announced. [Full story]

|

||

|

|

China's Jan exports drop 0.5% China's exports dropped 0.5 percent year-on-year in January, the first decline in two years as a week-long holiday distorted trade figures, official data showed Friday. Exports reached $149.94 billion in January, while imports slumped 15.3 percent year-on-year to $122.66 billion in January, the General Administration of Customs (GAC) said in a statement. [Full story]

|

||

|

|

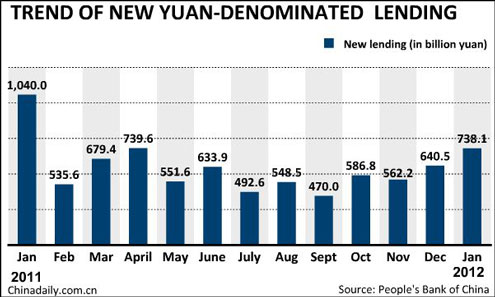

Decrease in lending deepens concerns Concerns over market liquidity and economic recession have become more acute after banks lent less than expected in January and the broad measure of money supply hit the lowest level since June 2001. Chinese lenders lent a total of 738.1 billion yuan ($117.3 billion) in the first month of 2012. "That's a lower figure than our expectations and the records over the years. Between 2009 and 2011, new yuan loans in the first month of the year were all above the level of 1 trillion yuan," said E Yongjian, an economist at Bank of Communications Co Ltd. [Full story] |

||

|

Comments & Opinion |

|||

|

Trade essential for growth China's cooperation with EU will help promote eurozone and solve the debt crisis in a sustainable and long-term way Premier Wen Jiabao made clear the Chinese government's stance on the European debt crisis during German Chancellor Angela Merkel's fifth official visit to China since taking office. Wen expressed the urgency and importance of solving Europe's debt crisis and said China is considering "involving itself more deeply in" efforts to address the debt issue. [Full story] |

|||

|

Trade surplus or false alarm US refuses to admit the benefits of bilateral trade and is ignorant of the damage its financial crisis has caused to China's economy The Wall Street Journal published an article on Sino-US trade last year, arguing that the flow of goods from China has deeply undermined the United States. The article quoted three American researchers as having said that the economic compromises the US has had to make because of competition from China are far beyond people's imagination. [Full story] |

|||

|

Serving the nation's future China should review and alter its policies for attracting foreign direct investment so that it taps the potential of service sector According to the latest data from the Ministry of Commerce, there has been a shift in foreign direct investment (FDI) in China from manufacturing to the service industry the most important industry for China's future. [Full story] |

|||