Yahoo, Alibaba reach agreement on buyback deal

(Xinhu) Updated: 2012-05-21 14:24SAN FRANCISCO - Yahoo Inc and Alibaba Group Holdings Ltd said Sunday evening that they have reached an agreement on a buyback plan for Yahoo's stake in China's largest e-commerce provider.

According to the agreement, Alibaba will repurchase half of Yahoo's 40-percent stake in the Chinese company, or approximately 20 percent of Alibaba's diluted shares, said the two companies in a joint statement.

Yahoo will receive at least $6.3 billion in cash and as much as $800 million in newly issued Alibaba preferred stock.

Meanwhile, at the time of Alibaba's initial public offering in the future, the Chinese company will be required either to purchase one-quarter of Yahoo's current stake at the IPO price or allow Yahoo to sell those shares in the IPO.

Yahoo and Alibaba believe this agreement to be the best path to align incentives and maximize value for shareholders of both companies, said the two companies in the statement.

It paves the way for Alibaba to achieve future public market liquidity for all of Alibaba's shareholders and provides Yahoo for a staged exit over time, balancing near-term liquidity and return of cash to shareholders with the opportunity to participate in future value appreciation of Alibaba, they said.

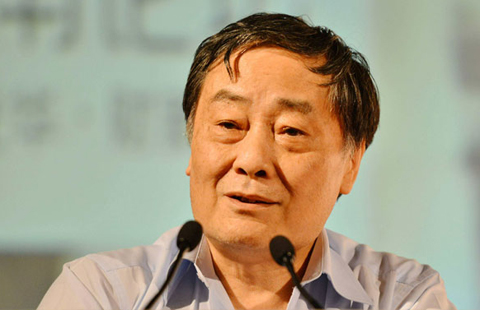

"This transaction opens a new chapter in our relationship with Yahoo," said Jack Ma, chairman and chief executive officer of Alibaba Group. "The transaction will establish a balanced ownership structure that enables Alibaba to take our business to the next level as a public company in the future."

Yahoo acquired approximately 40 percent stake in Alibaba in 2005 with $1 billion and Yahoo's Chinese operations. The Hangzhou, China-based company has been trying to buy back the stake in itself for more than a year.

- Finance Minister denies 300b gov't spending of public funds

- China lowers growth target, eyes better quality

- China to reduce foreign investment restrictions

- Economic quotes of the day

- China to stabilize property market in 2015

- China likely to maintain 7% growth for 20 years

- China to speed up implementation of free trade zone strategy

- More proactive fiscal policy will be implemented: govt