Advertising spending sees sluggish growth

By Meng Fanbin (China Daily) Updated: 2012-05-22 09:16China's advertising expenditure in traditional media, including newspapers, magazines, TV, radio and outdoor, increased just 1.4 percent in the first quarter, the lowest in nearly five years, according to a report released by CTR, a market information and research service provider in China.

Internet advertising expenditures increased by 25.9 percent, down from last year's 35.5 percent, according to statistics from IResearch, an organization focusing on researching China's Internet industry.

The trend is the same in the international advertising market, which has begun to show slow growth from last year.

China's GDP in the first quarter increased 8.1 percent year-on-year, the lowest in the past three years, which contributed to the drop in the advertising growth rate.

"Although the fluctuations in the advertising market are not exactly in line with those in the entire micro-economy, they are closely connected with the economic situation," said Professor Huang Shengmin, dean of the Advertising School at the Communication University of China.

"The first quarter is an off-season period for the ads. Despite the slowdown in growth, firms do not plan to reduce their annual advertising budget. They are waiting for a more appropriate time, " said Zhao Yihe, vice-president of Charm Communication.

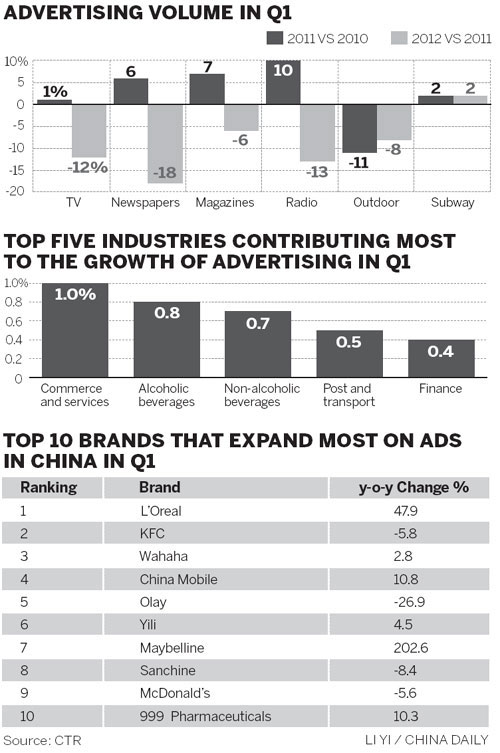

Newspaper advertising fell 6.3 percent year-on-year. Radio advertising grew 9.9 percent in the first quarter, and the drop in the growth rate sharply contrasted with the 39 percent growth seen last year, the report said.

Apart from the gloomy economy ,a slowdown in sectors including property and automobiles has affected the advertising market, Huang said.

China's total vehicle sales declined 3.4 percent year-on-year, and 4.79 million vehicles sold in the first quarter. This had a particular effect on radio advertising, which relies heavily on revenue from the auto industry.

Although TV still outclassed other traditional media, with the small screen retaining an overwhelming market share, spending on TV advertising grew just 1.9 percent year-on-year, dropping sharply from last year's growth rate of 17 percent, the report said.

Compared with last year, the duration of advertisements on China Central Television reduced significantly, while advertising expenditure declined 0.2 percent.

The length of commercials on provincial TV stations declined 14.8 percent year-on-year, but their advertising revenue increased 1.9 percent, thanks to increased advertising rates.

The duration of commercials during TV plays slumped in the first quarter because of a recently released regulation from the State Administration of Radio, Film and Television.

The supplementary provision for TV advertising said commercials, starting on Jan 1, are no longer allowed to appear in the middle of TV dramas lasting for 45 minutes.

Traditional outdoor advertisement spending increased 2.5 percent year-on-year, down 1.5 percentage points, and the post and transport industry experienced significant growth.

The fast development of rail transit in cities such as Beijing, Shanghai and Guangzhou injected fresh momentum into the outdoor advertising sector. Subway and light rail advertising spending increased 18.8 percent over the same period last year. Advertisements on TVs on buses and buildings boomed in the first quarter, up 26 percent and 35 percent respectively.

"Charm Group's total turnover increased 6 percent year-on-year in the first quarter, not only because our business covers new and traditional media, but also because our customers come from different industries," Zhao said.

Fast food brands such as KFC and website brands such as Moonbasa and Zhenai.com showed great enthusiasm for new media, like Internet and subway TV. Cosmetics and bathroom product companies reduced their spending on videos on buildings, the report said.

KFC and McDonald's reduced their advertising spending on traditional media, down 5.8 percent and 5.6 percent respectively. Owing to higher costs and fierce competition, the two multinational fast-food companies are seeking more affordable channels to advertise, the report said.

Among the top five fastest-growing industries in advertising spending, alcoholic beverages saw outstanding growth, up 14.7 percent, and more liquor companies attached importance to brand loyalty.

L'Oreal's market share of advertising on traditional media caught up with P&G's, soaring 47.9 percent. And Maybelline's advertising spending jumped 202.6 percent, making it enter the top 10 brands in advertising spending, the report said.

A report from L'Oreal showed that its sales volume hit 10.7 billion yuan ($1.7 billion) in 2011, an increase of 18 percent year-on-year. It was the 11th time that L'Oreal's sales rose more than 10 percent in China.

"The growth of China's advertising market could start to recover in the second half of this year, if China's economy doesn't experience a hard landing," Huang predicted.

Zhao was also confident about the development of China's advertising market. "With the start of the London Olympics, more companies are expected to increase their advertising spending."

"The confidence index of domestic enterprises remains stable in 2012. The growth rate of advertising expenditure will gradually rise this year, thanks to the emergence of some new sectors such as financial services, and the rapid development of new media, " he added.

mengfanbin@chinadaily.com.cn

- Chinese-built water project to sustain Ethiopian capital population

- China becomes second largest source of tourists to Sri Lanka

- With China's Silk Road initiative, SCO eyes bigger global role

- Chinese firms seek business link with Myanmar

- China February auto sales drop 0.2%

- Zhanjiang eyes trade growth with improved port facilities

- Rizhao aims for leading role in oil trade

- China approves new nuclear power project since 2011