Hanlong gets approval for $1.3b Sundance acquisition

By Du Juan (China Daily) Updated: 2012-06-26 10:38

China's Sichuan Hanlong (Group) Co Ltd announced on Monday that it has received approval from Australia's Foreign Investment Review Board for a $1.3 billion takeover of the iron ore company Sundance Resources, the latest overseas mining acquisition by China's private sector.

The deal is part of a trend of recent years that has seen both State-owned and private companies gain overseas mining assets despite potential risks, helping the country diversify its iron ore supply channels and reduce its dependence on imports.

Liu Han, chairman of Hanlong Group, said the acquisition will help guarantee the country's resource supply and sustainable development.

The Australia-based Sundance Resources said on Friday that Hanlong Mining, a subsidiary of Hanlong Group, received the Australian government's approval for the deal.

Hanlong Mining will buy all of Sundance's shares at $0.57 per share, said George Jones, chairman of Sundance.

He said gaining approval from the Australian government was a large step forward in the transaction.

However, Hanlong also has to gain approval from the National Development and Reform Commission by Saturday and credit approval from China Development Bank by Aug 31.

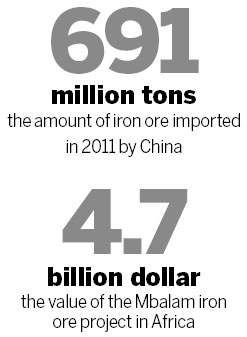

Hanlong's latest move targets Sundance's $4.7 billion Mbalam iron ore project in Africa. The project is on the border of Cameroon and the Republic of Congo.

The Cameroonian government said it will fully support the development of the project, which is estimated to account for about 8 percent of the country's GDP, Hanlong said.

The acquisition is expected to be completed by November, according to a statement made by Hanlong in May.

The company, established in 1997, has been discussing the deal with Sundance for almost a year.

The Mbalam project, which includes mines, ports and railways, will have an expected annual output of 35 million metric tons of iron ore during its first decade of exploration.

The mine has 2.8 billion tons in proven reserves, which can be mined for more than 50 years.

"If the iron ore output from the project is delivered to China, it will reduce the nation's dependence on major foreign mining companies, and help China gain pricing power in the international iron ore market," said Wang Guoqing, deputy director of the Langge Steel Information Research Center.

China imported 691 million tons of iron ore in 2011, according to customs figures. Imports now supply about 60 percent of the iron ore the country consumes.

Wang said that although the project has good support facilities that will greatly assist its operations, Hanlong faces a number of difficulties.

"Usually, State-owned companies have more overseas operational experience than private companies," said Wang.

"Moreover, political risks still exist in Africa, which may lead to an unstable investment environment and safety issues."

She added that Chinese investors' enthusiasm for overseas mining projects had slightly cooled in the past two years because many companies that had invested earlier failed to make profits.

dujuan@chinadaily.com.cn

- Tsinghua graduates invent 3-D pancake-printing machine

- $16b added by 50 brokerages to support shaky market

- Australia's opposition under pressure to approve China-Australia FTA

- China mulls intensified economic cooperation in border areas

- China to set up 60b yuan fund to support SMEs

- Luxury brands cash in on growth potential

- Chocolate companies see sales melt away

- Mondelez slims down after biscuit sector crumbles