|

|

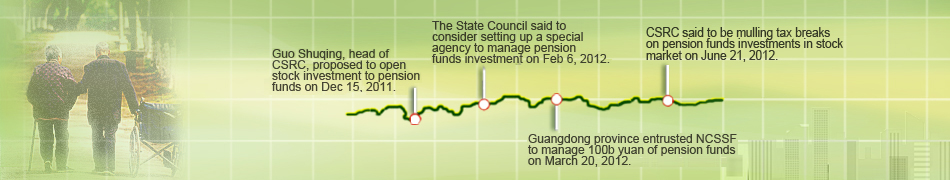

Editor's note: The population of China is ageing fast. Amid pressure from the inflation-eroded value and an expected shortfall of pension funds, subjecting the funds to the capital market may be a viable way out.

|

|

|

Tax breaks mulled on pension fund investment in stocks The securities watchdog is mulling offering tax breaks on stock market investments by China's pension funds amid pressure of an ageing population. New investment channels opened Speculation over investment plans for China's fast-depreciating pension funds settled after NCSSF was entrusted to manage 100 billion yuan of the funds. Specialized agency to be set up The State Council, or China's Cabinet, is considering to set up a new body to manage the investment of the basic pension fund. |

|

|

|

|

30% of pension fund may enter market Calculated in accordance with China's basic old-age insurance fund balance of 1.92 trillion yuan ($303.56 billion), up to about 580 billion yuan may enter the capital market. |

Capital markets to get pensions A Chinese province won permission to try out investing money from its largely unmanaged pension funds into the country's capital markets. Pension-fund investments will mainly go into fixed-income securities, which are largely risk-free in China. |

|

|

|

|

Over $300b in China's pension fund

Over $300b in China's pension fund

Local pension funds aim to tap financial sector

Local pension funds aim to tap financial sector Pension fund investment sees bleak return

Pension fund investment sees bleak return  Pension fund accesses to market in Guangdong

Pension fund accesses to market in Guangdong SSF eyes the 'real economy'

SSF eyes the 'real economy'

China sees huge gap in future pension payments

China sees huge gap in future pension payments Retirement age to be pushed back

Retirement age to be pushed back Pension proposal raises debate in China

Pension proposal raises debate in China  Worrying trend for pensions

Worrying trend for pensions