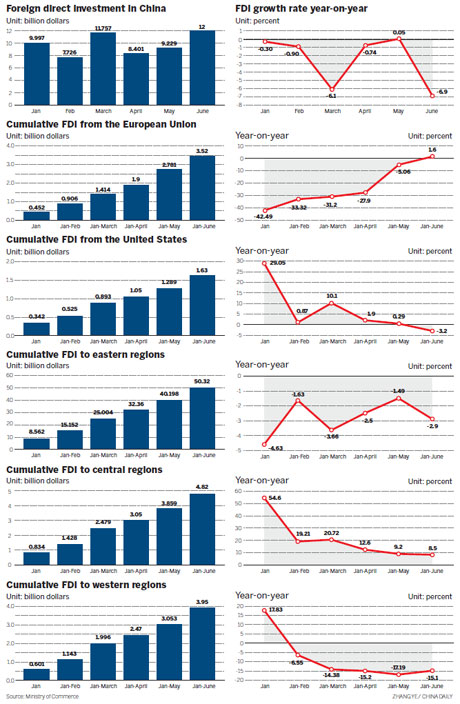

FDI drops 3% amid slowdown

By Li Jiabao (China Daily) Updated: 2012-07-18 09:39

China retained its position as the most attractive economy to multinational corporations in 2012, followed by the US and India, according to an annual survey of world investment prospects by the United Nations Conference on Trade and Development.

"This shows that multinational companies still have great confidence in China's development," Shen added.

Commerce Minister Chen Deming told foreign investors during a meeting on Friday that China will keep supporting the development of foreign enterprises in China while encouraging foreign investment in research and development as well as innovation.

"The huge domestic consumption market, which is expanding fast, provided great opportunities for foreign investors," Shen said.

The government has established a long-term mechanism to crack down on infringement of intellectual property rights, a move to improve the investment environment.

In the next step, the ministry will further open up the service sector and encourage foreign investment in emerging industries, modern agriculture and services, as well as energy conservation and environment protection. These measures will improve the country's use of foreign investments, Shen said.

In addition, the ministry is busy drafting the catalogue for the guidance of foreign investment industries in the central and western regions because foreign investors are enthusiastically investing in these areas after the government's encouragement," Shen added.

Huo said: "There is still room to enlarge the Industry Guidance Directory of Foreign Investment and improve the local investment environment. A broader investment field and better investment environment will ensure FDI flow into China in the long term."

The slow recovery of the world economy, rising costs at home and China's curbs on the real estate industry are jointly responsible for the slide of FDI into China in the first half of this year, according to Shen.

"Uncertainties in the world economy recovery, and the European debt crisis which still lacks a proper solution, affected the investment activities of multinational companies," Shen said.

The World Investment Report 2012 issued by the UNCTAD early this month said that the growth rate of global FDI will slow in 2012 with the value of both cross-border mergers and acquisitions and greenfield investments retreating in the first five months of 2012.

"Rising costs at home, including a shortage of land supply, also affect FDI in China. But the real estate industry is the major force driving down China's FDI expansion in the first half of this year," Shen said.

FDI flowing into China's real estate industry declined by 12.4 percent year-on-year in the first half of 2012 while FDI into China's financial industry surged by 73.3 percent in the same period, according to the ministry.

"The second half of this year will see China's imports pick up speed and the trade surplus in 2012 is likely to be bigger than last year's ($155.14 billion). But the proportion of the trade surplus in China's GDP or the whole-year trade volume will see no big change," Shen said.

lijiabao@chinadaily.com.cn

- In Guizhou, tequila after horse ride may become de rigueur

- When personal Wechat accounts go public, make money

- Top 10 cities with longest working hours in the world

- Testing times for big telecom firms as profit growth slows

- Datang's 'cloud' attracts startups

- China Merchants unit creates logistics JV with Lithuania

- Major carriers turn to Internet innovation

- Shanghai-London stock link plan on track, says LSE official