Mengniu eyes large-scale farms for raw milk

By Sophie He in Hong Kong (China Daily) Updated: 2012-08-29 10:01

|

|

|

China Mengniu Dairy Co Ltd plans to spend around 4 billion yuan ($631 million) on building wholly owned large ranches in China to meet part of its raw milk supply requirements.[Photo/Agencies] |

China Mengniu Dairy Co Ltd, the largest dairy products distributor in the country, hopes to source 100 percent of its raw milk supply from large-scale farms, up from the 85 percent currently, as part of its efforts to ensure product quality.

The company also plans to spend around 4 billion yuan ($631 million) on building wholly owned large ranches in China to meet part of its raw milk supply requirements.

Bai Ying, executive director at Mengniu, in announcing the company's interim results at a press conference in Hong Kong on Tuesday, said large-scale ranches were already under construction in Northeast China, North China and Northwest China.

"Currently, about 84 to 85 percent of our raw milk (supply) is from large-scale farms," Bai said, adding that by the year 2015, the proportion will be increased to 100 percent.

This is one of the company's moves to improve its product quality and safety by working on the raw milk supply sources, said Sun Yiping, chief executive officer at Mengniu.

In December 2011, products from Mengniu's Meishan plant were found to contain high levels of cancer-causing Aflatoxin M1.

|

|

"Following the detection of M1, our sales volume plunged 30 percent," said Sun, adding that despite the company's efforts in promotion and marketing, its sales volume in the first half of this year still contracted 5 percent from the same period a year ago.

Sun said that since the incident's impact has been gradually disappearing, Mengniu's sales volume has recovered to the levels before the December 2011 incident.

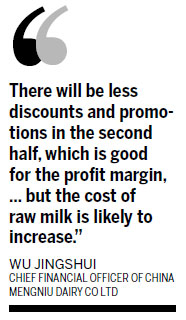

Wu Jingshui, chief financial officer at Mengniu, said that in order to protect its market share after the scandal, Mengniu had launched a series of promotions and discounts in the first half, causing its gross profit margin to contract 0.3 percentage point from a year ago to 25.7 percent.

"There will be less discounts and promotions in the second half, which is good for the profit margin, but the cost of raw milk is likely to increase," said Wu, adding that its gross profit margin in the second half may stay flat or see a "slight decrease" from the first half.

Jacqueline Ko, analyst at Kim Eng Securities, told China Daily that she is optimistic about Mengniu's performance in the second half.

"The management team told us that their sales were back to normal and as the company will reduce its promotions in the second half. Its gross profit margin will be increased from its first half level," said Ko.

Ko also said she believes that the company's commitment to constructing ranches in China is a positive gesture, as food quality is a major concern in the country, and the market will be happy to see the company's efforts on improving its quality control.

She added the company's valuation is cheap.

sophiehe@chinadailyhk.com

- Uber CEO: China to surpass Silicon Valley in innovation

- Chinese solar panel makers shift to Thailand for growth

- More export, wide use at home are nuclear's goal

- Top 10 smartphone vendors in the world

- China to manage liquidity without RRR cut: economist

- Hainan duty-free sales brisk in 2015

- Spillover effects of Chinese market fluctuation 'exaggerated': IMF deputy chief

- Calling China's slower growth 'catastrophe' is exaggeration: German FinMin