|

|

|

|

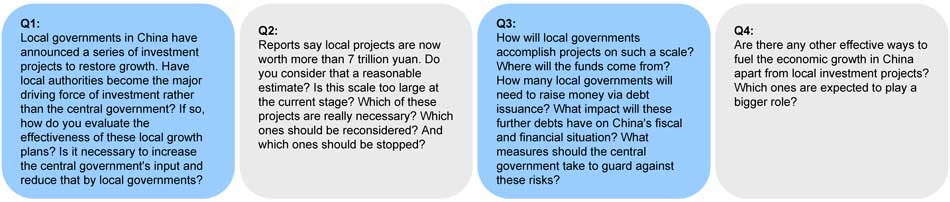

Editor's note: As Premier Wen Jiabao has said repeatedly over the past few weeks, maintaining economic growth is a national priority. However, where will the much-needed new driving force for growth come from? Talking about boosting growth, China business watchers know what the government did after the Wall Street meltdown in late 2008. For the next couple of years, it was the investment projects rolled out by the central government, initially worth 4 trillion yuan ($640 billion) in total, that helped China lead the world in GDP growth. Capital investment by the government can generate immediate power for growth, as Chinese leaders have said. But this time around, it is local government projects - those decided by planning officials at the provincial or municipal level - that seem to dominate the list of newly announced projects, with the local investment plans amounting to 7 trillion or even 8 trillion yuan. But how much can China really count on local projects to boost its growth? Are there alternatives to spending so much and inevitably incurring so much local debt? China Daily has invited several economists to give their comments.

Previous Issues:

|

|

What does the second half hold in store? What does the second half hold in store? |

No short-term end to eurozone crisis No short-term end to eurozone crisis |

What should China do if Greece quit eurozone? What should China do if Greece quit eurozone? |

|

|

Local governments' financing potential has become very limited since the last round of expansion in 2008 and 2009. No matter whether they prefer to issue bonds or borrow from banks, it's no longer up to them any more. They need approval from the central bank and support from the banks. But after the credit expansion then, banks are no longer positive about lending money to them given the already deteriorating asset quality. Compared to three years ago, the government faces tighter fiscal and financial policy constraints, with slowing tax revenues, falling land sales and sluggish bank lending. Policymakers hoped that the corporate sector would also play a role through increasing investment in areas such as clean energy. But the corporate sector's investment response is not as fast as that from local governments, especially at a time of economic slowdown.

Although 7 trillion yuan sounds huge, these programs are just blueprints as local government officials have just taken office ahead of the leadership transition at the national level, and most of the programs will last for several years. That's quite different from the 4 trillion yuan stimulus package during the global financial crisis in 2008. Most of the projects involve setting up industrial zones, especially for some emerging strategic industries. But the question is whether overinvestment will generate a new round of excessive production capacity and create more problems. It's better to let businesses and the market decide.

The government may increase direct spending, by using the Ministry of Finance's adjustment fund of up to 3 trillion yuan; it may lower tax burdens for Chinese businesses, possibly raising the export tax rebate by a maximum of 3 percentage points; and it may also subsidize consumer spending by providing cash subsidies, cheap consumer credit and tax discounts. Reducing the tax burden on businesses would be a more practical way to spur the economy, although fiscal revenue growth showed some signs of declines. -----Huang Yiping Chief Economist for Emerging Asia at the investment banking devision of Barclays Bank Plc |

|

|

The Chinese authorities are responding to the deterioration in the outlook for the global economy and China's exports with a smaller version of the 2009 stimulus. It is inevitable this will be investment-led because that is the easiest way to get growth quickly. China has the fiscal and financial resources to ensure a so-called soft landing for the economy in 2012, but only at the cost of postponing the resolution of the economy's structural imbalance toward investment. That imbalance is a structural weakness that contributes to the negative outlook on Fitch's AA- local currency rating for China. Meanwhile, the foreign currency rating of A+ remains well supported with a stable outlook by China's exceptionally strong foreign currency sovereign balance sheet, underpinned by $3.2 trillion offoreign exchange reserves.

The key issue for the authorities is likely to be maintaining employment, rather than the technical efficiency of the projects. Headline urban unemployment remains modest at just 4.1 percent in the second quarter of 2012, and the Ministry of Labor and Human Resources continues to report a surplus of vacancies over job seekers, in stark contrast to 2009. However, the real picture for the labor market is probably less good - higher-frequency data show a decline in employment growth and a fall in migrant labor movement through July, while there is anecdotal evidence of exporting firms in provinces likeGuangdonglaying off workers.

Still, we believe the authorities are already concerned about the buildup of local government indebtedness since the 2009 stimulus, and the prospects for some of that lending to turn bad, impacting the banking system. National Audit Office data show local government debt rose to about 27 percent of GDP by the end of 2010 from 18 percent at the end of 2008. The prospect that bank asset quality will deteriorate, potentially leading to a requirement for support from the sovereign, is one of the issues contributing to the negative outlook on the local currency rating. This means China's public finances are less strong than is often supposed - we think a debt measure comparable to other countries will be about 49 percent of GDP by the end of 2012, which is about equal to the median for China's peers in the "A" rating range - not a weakness, but not a strength either. It may be more likely for financing for any new stimulus this year and next to be raised via local government financing vehicles with more or less informal local government guarantees.

This is unlikely to be exports given the outlook for the global economy, so that leaves the government and households. Experience with some higher-income economies in the West shows that it is unsustainable for government spending - and so deficits - to grow faster than the economy, so that just leaves households. This comes back to the point we started with about "rebalancing" toward consumption. One possibility is that financial liberalization may lead to higher interest rates for households on their deposits, which might make it possible for households to achieve their savings goals with less saving, leaving more over for consumption. However it is achieved, rebalancing implies deep and wide-ranging reform of China's economic structure - and it might be a bumpy process. Still, it has to be faced at some point because investment cannot go on rising forever as a share of GDP. Uncertainty over when and how rebalancing occurs and what the costs might be is one factor that contributes to China's rating of A+ - still a high rating, but below some higher-income countries - despite the strength of the sovereign balance sheet. -----Andrew Colquhoun |

|

|

As far as the type of projects are concerned, as an example, Hunan province has indicated that it will invest in or build 10 core townships, 10 infrastructure projects including transport systems, 10 film-production districts, and 10 industrial development projects. Local governments should obviously continue to improve the local infrastructure - airports, roads, water treatment and energy plants, which is what they seem to be doing - and select with great care the industry sectors in which they will invest. Needless to say, I always believe that partnerships with independent companies are always best for governments when they invest in industrial sectors.

A real effort should be made by China to explain what China is today, to help people better understand that there is plenty of room for partnership with China. -----Daniel Kahn Founding partner of French law firm Kahn & Associes in Paris |

|

|

The investment surge can help stabilize economic growth. It is not important to discuss whether to expand or limit the investment from the central or local level, but avoiding inefficient projects and preventing excess production capacity are the key. The new round of investment boosting should be in line with economic restructuring.

Meanwhile, the national budget fund was increasing fast, and was 30.5 percent more than a year earlier. But the budget fund was only 4.5 percent of the investment. Because the central bank has loosened monetary policy, the liquidity of domestic capital markets is easing and the amount of new loans during the January-to-July period was 6.7 percent more than last year, accounting for 13.1 percent of the total investment fund. The fund structure is healthy now. However, we cannot loosen supervision on local financing platforms, especially when the property sector - one of the most important economic pillars of local government - has been seriously controlled. The local fiscal resources are decreasing fast, so much more attention should be paid to risk control.

It is also important to boost the modern service industry, which can help facilitate the fast growth of consumption. -----Pan Jiancheng Deputy director-general of China Economic Monitoring and Analysis Center, National bureau of Statistics |

|