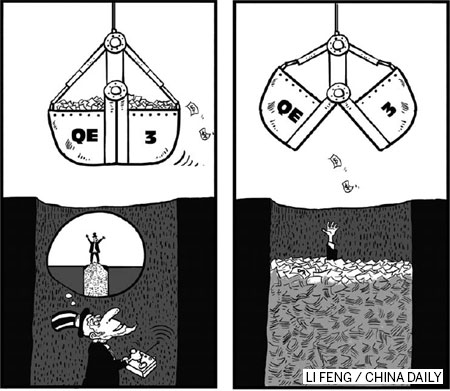

Another QE is a bad idea for US

By Yao Yang (China Daily) Updated: 2012-09-12 15:41

US Federal Reserve (Fed) President Ben Bernanke's speech in Jackson Hole, Wyoming, on Aug 31 has raised speculation that a third round of quantitative easing (QE3) is in the offing. Before the Fed takes a decision at its upcoming board meeting on Sept 12-13, the market doesn't know what turn to take. In the meanwhile, prices of precious metals and oil have risen.

The Fed claims the two rounds of QE have raised American GDP by 3 percent and created 2 million jobs. But many economists doubt the numbers.

The Fed carries two mandates: monetary stability and full employment. This often places it in a contradictory position, just like what is happening now. The US economy is growing at a moderate rate but robustly, not lower than its long-term average.

The problem, however, is that jobs are not being created at a comparable rate. Will another round of QE create more jobs? The chances for that are slim, because there is more than enough money in the market. American banks are sitting on piles of deposits but don't want to lend. And large corporations are sitting on mounds of cash but don't know where to invest. The only sector that needs money is the small and medium-sized enterprises (SMEs), but banks do not want to give them loans because of the risks involved.

Most observers read the short-term macroeconomic necessities to guess the Fed's move. But the Fed's approach to monetary policy has been shaped by two other fundamental factors: bad politics and bad economics.

On the political side, the standoff between the two major US parties, the Republicans and the Democrats, has prevented a serious fiscal stimulus plan. The debate on federal debts has taken the federal government to one after another fiscal "cliff". Republican congressmen are ready to vote down any real fiscal expansion plan. As a result, the Fed also has to shoulder the task of boosting employment.

However, monetary policy affects aggregate parameters such as prices and interest rates and is much less effective than fiscal policy when it comes to targeting specific sectors such as the SMEs.

On the economic side, American economists are so used to studying the US economy as a seamless whole that they don't want to accept it has structural problems, because for them, structural problems are a developing countries' issue. Yet in a globalizing world, every country has to undergo some structural changes. The emerging economies, noticeably China, India and Brazil, are changing the global economic landscape.

Among all the changes, the reallocation of jobs poses the most serious challenge to developed countries. Products that used to be made in developed countries are now being produced in emerging economies at much lower costs. As a result, developed countries might have lost forever the chance to create low-end jobs.

The last point may well explain why the US is experiencing jobless growth. Over the past two centuries, the US has developed a version of "high capitalism" that emphasizes the concept of high-end innovation, high profits, high salaries and, above all, winner-takes-it-all.

This version of capitalism has worked well to help US become the world's largest economy. But now the US faces serious challenges with the emerging countries beginning to take away its jobs in large numbers. The US has successfully dealt with the challenges posed by Japan. But this time the crisis is different; its scale is much larger and it's going to last much longer.

One of the key pitfalls of American high capitalism is that it despises medium-range technical jobs. Becoming a chief engineer of GE used to be the dream of an MIT graduate. But now the only place the brightest MIT graduate wants to go to is Wall Street.

The American education system rests on a false euphuism that everyone is a genius and, hence, its emphasis is on encouraging innovative ideas, not to enhance the knowledge of students. That has made American college graduates ill-equipped to take up medium-range jobs, which then have to be outsourced to the emerging countries.

It seems that Bernanke has not been able to identify the key problems facing the American economy. Instead of boosting employment, another round of QE will only dope the asset and commodity markets, a move most working people there do not like.

More than that, it will accelerate the transfer of America's future wealth to other countries, especially the emerging countries, because the greater the proliferation of dollars the larger the debt of the US to the rest of the world.

The author is a professor and director of China Center for Economic Research, Peking University.

- Xiaomi introduces video call app with US firm

- Asian woes take toll on AIA Group

- Regulator quashes registration-based IPO rumors

- Foxconn casts doubt on Sharp deal

- Products presented at MWC in Barcelona

- Industrial diversity pays benefits for local economy

- 'Invented-in-China’ products to the fore at MWC

- China lawmaker calls for coordinated financial regulation