Profits of China's SOEs fall 12.8% in Jan-Aug

By Wei Tian (chinadaily.com.cn) Updated: 2012-09-18 15:38State-owned enterprises reported profits of 1.34 trillion yuan ($218 billion) in the first eight months of the year, 12.8 percent less than in the same period last year, the Ministry of Finance said on Monday.

August extended the year-on-year declining trend seen in the first seven months, though profits were up 1.1 percent compared with July.

The revenue of SOEs was up 9.7 percent in the first eight months, but the increase was outpaced by even faster growing costs.

According to the Finance Ministry, total costs and expenses for SOEs were up 11.5 percent in the first eight months.

Lu Zhengwei, chief economist with the Industrial Bank Co, said that expenses with taxes have been growing since 2009, and it's time to launch more measures to lower the tax burden for companies.

Cao Jianhai, a researcher with the Chinese Academy of Social Sciences, said the shrinking profits of SOEs — which were the worst hit among all types of companies amid the economic slowdown — are closely related to their expansion during the 2008 stimulus program.

The National Development and Reform Commission has recently approved a new round of investment-driven projects, which may help restore the profits for SOEs in the near future, Cao said. However, policy-driven growth for profits is unhealthy, he added.

In a breakdown of industries, the tobacco, electricity, and automobile sectors saw growing profits, while the chemical, nonferrous, transport, building materials, and petrochemical industries saw sharp declines.

According to Haitong Securities, the profits of downstream industries are stabilizing, whereas companies in the upper and middle reaches may see a further decline in profits.

- Profits continue to decline at China's SOEs

- Xuzhou, SOEs reach massive investment deals

- SOEs pay $286b in taxes, fees in Jan-July

- SOEs' tax payments up 13.5%

- China central SOEs' profits down in Jan-July

- Survey shows SOE jobs are top choice

- SOEs shines on well-publicized rich lists

- SOEs' Jan-July profit decreases 13.2%

- China to ease permanent resident application for foreigners

- China's population to reach 1.42 billion by 2020

- China to create 10 million jobs in 2016

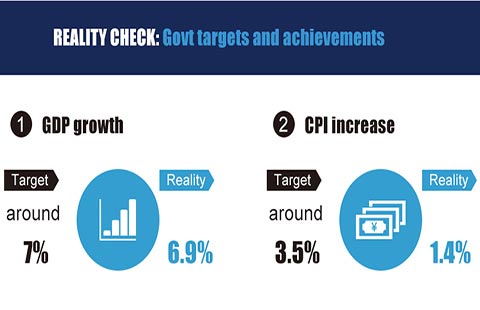

- China to keep inflation at around 3% in 2016

- China to cap energy consumption in 2016-2020 period

- China to realize RMB convertibility on capital account

- China to build second railway linking Tibet with inland

- China to keep RMB exchange rate generally stable: report