Assembly lines halted by islands row

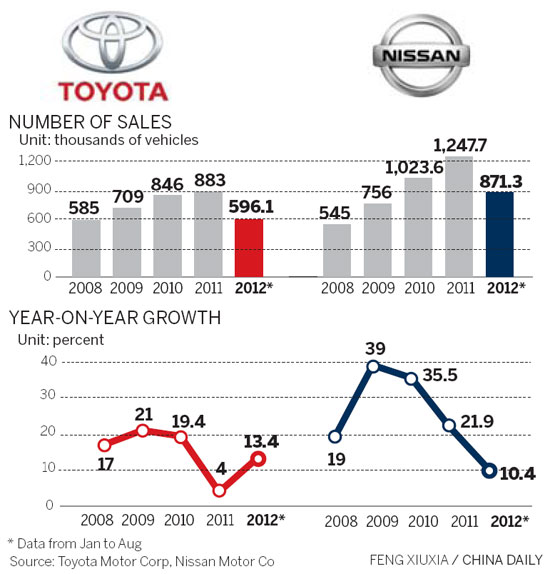

By Wei Tian and Han Tianyang (China Daily) Updated: 2012-09-27 09:11Japanese automakers including Toyota Motor Corp and Nissan Motor Co are slowing their production in the world's biggest auto market as tension between Japan and China depresses demand for their vehicles.

The Japanese automakers' decision to reduce their output in China comes after protests broke out over the Japanese government's illegal "purchase" of the Diaoyu Islands.

Related reading: New hurdle for Japan's carmakers

"For the time being, I think you're going to see Japanese automakers' sales in China decrease by 20 to 30 percent," said Koji Endo, auto analyst at Advanced Research Japan Co Ltd.

"The last time we had protests like this was in 2010 and they only affected things for about a month. But I think it's going to be different this time. This is going to have serious consequences."

|

A Toyota Motor Corp employee inspects a vehicle at the company's assembly line in Tianjin. Toyota has idled its plants in Tianjin and Guangzhou, but said production will resume in October after the week-long National Day holiday. [Photo/China Daily] |

Nissan, the top Japanese automaker in China measured by sales, said on Wednesday that it will bring production to a stop at a joint venture it has in China starting on Thursday, three days earlier than planned. The halt is to extend through the National Day holiday next week.

Toyota said it planned to suspend production at its plants in Tianjin and Guangzhou starting on Wednesday, also earlier than initially scheduled. The company denied media reports saying it would halt its production in China for the entire month of October.

Xu Yimin, group manager for Toyota China's corporate communication department, said the Toyota factory will be back in operation after the National Day and Mid-Autumn Festival holidays, which will last from Sunday to Oct 7 this year. He said the company's plans do not call for bringing production to a "complete halt".

He said the decrease in demand has led to an early holiday for workers at some of the factories.

Toyota's exports to China "will be adjusted according to market demand", Xu said.

But "we are still hoping to meet a 1-million-sales target for this year, and that target hasn't been changed."

Reuters, though, quoted a senior Toyota executive in Beijing as saying that "the company probably won't be able to meet its goal of selling one million cars in China this year". In 2011, Toyota, working with Chinese partners, managed to sell about 900,000 vehicles in the country.

Shen Li, spokeswoman for Nissan China, said Nissan aims to deliver 1.35 million vehicles in China this year.

John Zeng, director of Asia Pacific Forecasting, LMC Automotive, said Japanese auto brands are likely to miss their sales targets in China this year.

"It is the worst scenario for Japanese automakers in China in the last 40 years," he said.

In August, Nissan produced 86,488 vehicles in China, down 8.9 percent year-on-year, according to a statement from the automaker. The same month saw Toyota produce 67,625 vehicles in China, down 18 percent year-on-year.

|

|

Nissan generates about 30 percent of its profits in China, Toyota about 17 percent and Honda Motor Co Ltd about 15 percent, according to the financial services company Goldman Sachs Group Inc.

Mazda Motor Corp has decided to halt production at its operations in China on Friday and Saturday, giving workers two extra days off for the National Day holiday.

And Suzuki Motor Corp said it has stopped one of the two production shifts it normally runs in China.

"Japanese automakers are adopting a more conservative strategy in the Chinese market, even more conservative than they took after the 2011 earthquake," Zeng said.

The political tensions are likely to affect the companies' plans to promote their brands, he added.

"When the current situation fades away, these companies may consider producing more localized brands, rather than ones that use the Toyota or Honda logo," he said. "The people who own cars with those brands will continue to be fearful."

According to an estimate by China's Passenger Car Association, this year will see Japanese vehicles lose the lead they have had over German vehicles in the country since 2005.

The Japanese car brands' market share will probably decrease to 22 percent this year and German brands' will increase to 22.5 percent, according to the association's projections.

Contact the writers at weitian@chinadaily.com.cn and hantianyang@chinadaily.com.cn

Reuters contributed to this story.

- Toyota: China deliveries may double by 2015

- Toyota to recall 160,000 autos in China

- Nissan Motor's China sales fall in July

- Nissan plans $785m NE China plant

- Sino-Japan economic relationship hurt

- Soured China-Japan ties bring chill to Tokyo stores

- Islands 'purchase' hurts major industry sectors

- Japanese automakers face tough times in China

- China's favorite retro cola makes comeback

- Chinese vice premier stresses anti-counterfeiting

- Warner Bros, Chinese partner to release 12 films

- China's home prices continue to rise

- 'Naked official' of Chinese media group under probe

- Tibetan IPO rush continues with new Shanghai listing

- Pharma tycoon looks for overseas healthcare deals

- More automakers to buy Hunan Corun hybrid powertrains