Market flat, Japan-brand sales plummet

By John Zeng (China Daily) Updated: 2012-10-22 10:57

|

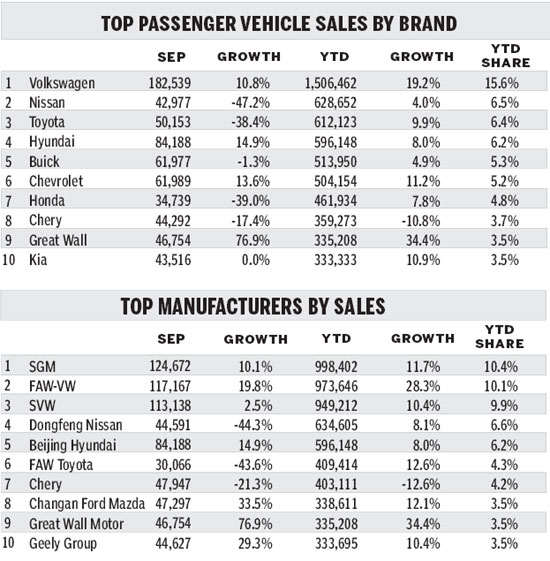

Plummeting Japanese sales in the wake of an ongoing diplomatic dispute were largely responsible for a sluggish September as China's auto market declined 1 percent to 1.6 million units sold.

Combined Japanese-brand car sales for the month declined 41 percent to around 160,000 units, far lower than original estimates. That translates to 110,000 fewer sales and $2 billion in lost revenue.

All major Japanese brands were badly hurt: Nissan, Toyota and Honda had sales declines ranging from 47 percent to 39 percent. As a result, they are now cutting shifts or even halting production.

The 1.2 million units sold in the overall market meant no growth compared with the same month last year. Commercial vehicle sales only reached 400,000 million units, a decline of 6 percent year-on-year.

The projected total sales figure for the year based on September figures is now 18.46 million units, down 5 percent from the 19.4 million unit estimate last month.

|

On segment level, the performance of minicars and subcompact cars remained weak in September, declining by 16 percent and 8 percent respectively.

Although SUV and luxury car sales continued to increase in September, the growth rate was significantly lower than the previous months.

But even amid the sluggish market, most non-Japanese automakers benefited from the decline of Japanese brands.

Great Wall's sales surged by 77 percent in September on the strength of its SUV models.

Geely and JAC also achieved remarkable sales, increasing by 25 percent and 22 percent respectively.

|

|||

Although the immediate damage is being felt by the Japanese, worsening relations between China and Japan is likely to drive away Japanese investment, the third-largest source of foreign direct investment in China.

Of greater concern in the short term is the heavy reliance of the Chinese auto sector on Japanese auto components.

Japanese companies supplied 58 percent of imported auto transmissions in the first eight months of this year. Further diplomatic tensions could disrupt the supply chain.

Taking the factors into account, our forecast for growth in 2012 passenger vehicle sales has now been revised down from 9.4 percent to 8.2 percent.

The writer is the director of Asia Pacific Forecasting at LMC Automotive. He can be contacted at JZeng@lmc-auto.com.

|

For more subscription details of Auto China, please visit our E-Shop.

Japanese car sales drops

Diplomatic row a blow to Japanese brands

Japanese carmakers report Sept sales as 'disastrous'

Diaoyu row hurts Japanese car sales in China

Japan carmakers to cut China production by half

Peugeot sales rise as Chinese snub Japanese cars

- Japan carmakers to cut China production by half

- Should we boycott Japan goods?

- Japanese exhibitors fret over fallout from Diaoyu row

- Diplomatic row a blow to Japanese brands

- Peugeot sales rise as Chinese snub Japanese cars

- Japanese carmakers report Sept sales as 'disastrous'

- Diaoyu row hurts Japanese car sales in China

- Shanghai index plunges by 2.3%, drops below 3,000 level

- China's Hainan sees robust tourism growth from foreign visitors

- Baidu to turn online video unit independent operation

- More outside investments flow in mid-range smartphone market

- China Film plans IPO this year

- Social security premium to reduce from May 1

- Yuan firms on improving economy

- Day in the life of a webcasting anchor