Provinces register faster GDP growth

By Zheng Yangpeng (China Daily) Updated: 2012-10-24 09:54Figures suggest looming recovery as stimulus measures start to take effect

The latest GDP figures from the eastern provinces suggest China's economic growth decline might have come to an end and started to rebound, analyst said.

Guangdong province, China's largest economic powerhouse, posted a 7.9 percent year-on-year growth in the first three quarters of this year. The growth rate, though lower than last year's, was half a percentage point higher than it was in the first half of the year.

The provincial statistics bureaus do not release data for a single quarter.

Investment, a major engine of China's economic growth, also showed a rebound in Guangdong, where fixed-asset investment in the first three quarters grew by 13.9 percent, compared with 11 percent in the first half-year. "The rebound in the investment sector showed that a raft of stimulus measures enacted by the central and local governments, mainly in the infrastructure sector, have been taking effect," said Xu Fengxian, a regional economics expert at the Chinese Academy of Social Sciences.

Jiangsu, the second-largest province in China in terms of GDP, also registered faster growth. In the first three quarters, its economy expanded by 10.1 percent, 0.2 percentage point higher than that of the first half-year.

While in Zhejiang, another coastal province with an export-oriented economy, GDP grew by 7.7 percent, 0.3 percentage points higher than that of the first half of the year.

"The ducks know it first when water gets warmer in the spring," said Sheng Laiyun, spokesman for the National Bureau of Statistics, citing a Chinese proverb. "Historically, eastern provinces are among the first to sense the tipping point in the national economy."

Cheng Jiansan, a regional economics expert in Guangdong, also said the province's economic rallies and slumps are usually a quarter to a half-year ahead of the nation.

China's annual economic growth slowed to 7.4 percent in the third quarter from 7.6 percent in the second - the seventh consecutive quarter of slower expansion - but the acceleration in some monthly indicators for September showed that the economy may bottom out in the fourth quarter.

Industrial production, retail sales and investment data were all slightly above forecast in September, and the 2.2 percent quarter-on-quarter GDP growth was the strongest since the third quarter of 2011.

Matthew Circosta, an economist from Moody's Analytics, said that China's industrial production improved to 9.2 percent over the year to September, up from August's 8.9 percent.

"This suggests that the Chinese economy is beginning to stabilize," Circosta said. "Besides, the government's infrastructure investment drive is starting to show up in stronger production of metals, building products, and trains."

The strong rebound is a major force to fuel Tianjin to grow by 13.9 percent in the first three quarters, the fastest rate among provinces and municipalities that have released their latest data so far.

Though growing significantly faster than the coastal regions, the central and western regions are still experiencing the pinch of the national economic growth slowdown. Most hinterland regions have seen slower growth in the first three quarters.

For example, Sichuan, the largest province in the western part of China in terms of GDP, saw a 12.8 percent growth in the first nine months. The growth, though much higher than the national average, is 0.3 percentage points lower than that of the first half-year.

Though confident in the growth of the fourth quarter, economists said China has to accelerate the upgrade of its economic growth model.

Jing Ulrich, managing director of global markets China at JPMorgan Chase & Co, said China's economy is stabilizing and estimated a faster growth in the fourth quarter, albeit improving at a marginal level.

"Though the growth fell under 8 percent, the government did not show a strong anxiety sentiment, which suggested it has accepted the current growth rate and will not introduce a massive stimulus package," Ulrich said.

"Momentum in the future should come from economic transition, not massive monetary or investment stimuli."

zhengyangpeng@chinadaily.com.cn

- PBOC injects huge liquidity to market

- Xiaomi, UnionPay partner for mobile payment service

- New Zealand kiwifruit giant looks to China for year-round supply

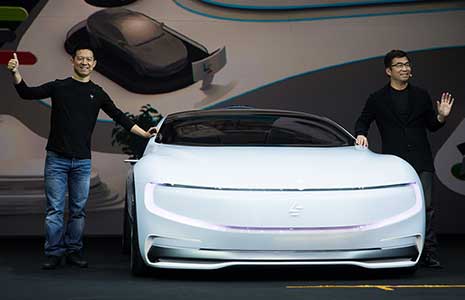

- Latest technologies dazzle at Shanghai tech-fair

- Wanda promises 12% return to investors backing the buyout

- China's urban unemployment rate at 4.04%

- China's free trade zones pilot reforms for efficiency and openness

- New Zealand tourist industry excited by multi-million-dollar deal with China