China grabs top spot for global FDI

By Tom McGregor (chinadaily.com.cn) Updated: 2012-10-25 11:23China has surpassed the US to become the world's largest recipient of foreign direct investment in the first six months of the year, as disclosed by the United Nations Conference of Trade and Development.

But how long will the nation maintain its top ranking? The sputtering global economy helped China capture the prominent position. Xinhua quotes Zhan Xiaoning, director of UNCTAD Division of Investment and Enterprise, as saying, "it's mainly due to a 39.2 percent fall in FDI flows to the US, compared to a three percent decline in China."

Accordingly, some Western economists and journalists might dismiss China's top ranking for FDI as just lucky and argue the US would regain its number one status soon.

UNCTAD already hinted that, "early indications show that FDI flows to the US might be stronger in the second half of 2012." The US will probably return to lead in the rankings, but the real question should be, how long before China outranks the US for attracting foreign investments on a consistent basis?

It may depend on whether the US pursues isolationist trade policies or endorses a pro-growth open consumer market that welcomes imports along with foreign investments.

In their campaigns, US presidential candidates – GOP nominee Mitt Romney and President Barack Obama – talked tough about China, but in their third and final debate, they softened their stances against the country. Romney said he wishes to avoid a trade war, but would still insist on pushing for a higher-valued Chinese RMB currency.

Both countries would enjoy better cooperation, as they grow richer together. However, we cannot assume that relations between the two countries will be perfect, but there will be a common understanding to avoid a trade war.

Perhaps, the fight for top ranking for global FDI for both countries might transform into a spectators' sport. Just like watching a basketball game between two teams, with players and coaches that are equally talented and motivated.

Using this analogy may seem irrelevant, but too often political, diplomatic and economic competition has become too intense and bitter. Both sides should reduce simmering tensions and accept each other as equal but different countries. The saying, "winning isn't everything, it's the only thing," should not be the primary focus.

Anyway, the China vs US foreign investments challenge would remain a closely contested match.

According to Global Investment Trends Monitor, "in the first six months of the year, China attracted $59.1 billion in FDI, while the US attracted $57.4 billion." That's a difference of less than $2 billion.

Indo Asian News Network reports that, "UNCTAD projects the FDI flows will, at best, level-off in 2012 at slightly below $1.6 trillion."

Fortunately, China's Vice Premier Li Keqiang had recently touted a proposal to cut taxes, which would spark more foreign investments.

The US would be poised to enjoy stronger economic growth along with China. The pivotal factors for both countries would be to encourage more foreign investments with beneficial government policies that favor lower taxes, less regulations and open attitudes.

China is transforming from a manufacturing-based and exports-driven economy to a nation that relies more on its service sector and retail sales. The country needs more foreign investments, as well as business expertise from the US.

Meanwhile, the US seeks to overcome slow economic growth rates and Chinese investors can bring in more FDI inflows for the US to re-ignite the American Dream. Therefore both countries could enjoy better benefits by acting more as friends than as adversaries.

The views do not necessarily reflect those of China Daily.

Mcgregor@chinadaily.com.cn

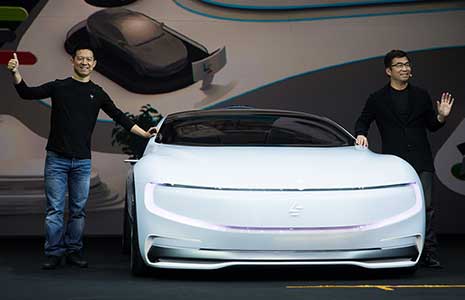

- Concept cars shine at Auto China 2016

- Top quotes of business tycoons at China Green Companies Summit

- Russia's YotaPhone targets Chinese 'trend setters'

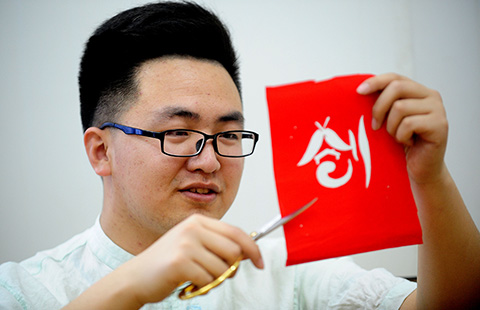

- Small firms turning to NEEQ for financing

- Value of tradable shares down 4%

- Dongfeng Auto reports sales decline, profits jump

- Guotai Junan Securities profits soar in 2015

- China's biggest travel agency posts 7.86% rise in Q1 profit