Companies turn to ChiNext exchange even as returns fall

By Cai Xiao (China Daily) Updated: 2012-10-30 10:31

The past three years have seen a steady decrease in the returns made by investors in Chinese companies listed on ChiNext, a Nasdaq-style market under the Shenzhen Stock Exchange.

Even so, venture capital and private-equity institutions still regard the market as an important means of exiting from their own investments.

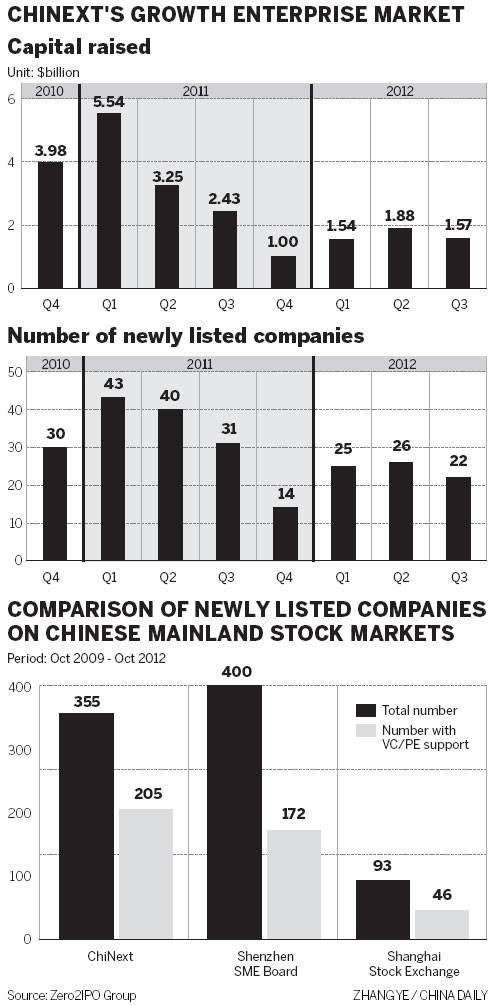

In the three years of ChiNext's existence, 355 Chinese companies were listed on the market, raising $34.4 billion. Those transactions made up 41.8 percent of the IPOs that occurred on the Chinese mainland during the period and generated 24 percent of the money that was raised in the offerings, according to a report released by the market researcher Zero2IPO Research Center on Monday.

Of the 355 companies, 205 were backed by venture capital or private-equity companies. In the third year of ChiNext's existence, investors in them saw an average return that was 6.1 times the value of their original investments. In the second year, the average return was 8.4 times the original investment and it was 9.5 times in the first.

"We are glad to see the role that ChiNext played in the past three years but the golden period hasn't come for us yet," said Wu Gang, chairman of Kunwu Jiuding Capital Co Ltd, a leading domestic private-equity company.

"The consecutive decrease in investment returns was mainly the result of the currently weak stock market and we are patiently awaiting its recovery."

Kunwu Jiuding Capital helped five Chinese companies get listed on ChiNext between 2009 and 2012, and is working to prepare a sixth, Henan Yuhua PV New Materials Co Ltd, to hold an IPO on the same market.

Yi Jigang, president of Orient Jiyi Investment, a Beijing-based private-equity firm, said many good investment opportunities existed when ChiNext opened at the end of October 2009, and investors could easily obtain good returns during that time.

But the good deals have become scarcer and competition among equity investors has grown fiercer, leading to a decrease in returns.

"Having companies listed on ChiNext will continue to be an important means of exiting from our portfolio companies," Yi said. "Venture capital and private-equity companies that aren't strong in financing, investment and management will die. The best ones will be patient about cultivating companies and aim to achieve good returns after six to eight years."

Hong Hao, managing director and chief strategist at the investment banking and securities company BOCOM International Holdings Co Ltd, said some businesses listed on ChiNext are also struggling with financial difficulties and have not been able to fulfill the promise they had when they first formed their IPO plans.

"As China adopts delisting policies for the development of the ChiNext market, it will play an important role in promoting China's real economic development," Hong said.

In the first three quarters of this year, the average price-to-earnings ratios of companies listed on ChiNext were all between 30 and 40. The highest average seen on the exchange, 79.9, came in the fourth quarter of 2010, according to the report by Zero2IPO.

Li Yizheng, vice-president of China Securities Co Ltd, said the market has become more rational for companies on ChiNext and some of them have great potential, but others do not.

"These companies have risks because they aren't strong enough to compete with industry giants if they come to do similar business," Li said.

caixiao@chinadaily.com.cn

- Alibaba's mobile browser to reinvent itself as new media platform

- Two students return from abroad to open beer factory

- Data good enough to dispel doubt over China's economy

- China's appetite for cross-border acquisitions to grow

- Vanke's net profit up 28.1% in Q1

- Hesitation over MSCI inclusion of China's A-shares serves nobody

- Domestic demand, innovation to maintain China's economic growth: Russian expert

- Hainan airlines to launch direct flight to Tel Aviv