Turning point in central bank's monetary policy

By Hu Yuanyuan (chinadaily.com.cn) Updated: 2012-11-12 17:12China's monetary policy has probably reached a cyclical turning point, the financial services company Barclays PLC said in a research note on Monday.

In the coming months, the priority is likely to change from cautious easing to something more neutral, and an emphasis will be placed on maintaining stable liquidity, the company said.

The recently released Monetary Policy Report for the third quarter of 2012 made special note of the importance of preventative, targeted and flexible adjustments to monetary policy, which should try to strike a balance among economic growth, price stability and controlling risks. The first priority will be to maintain stable monetary conditions.

"Our reading of the third-quarter Monetary Policy Report is that the policy focus is shifting back to maintaining stable market liquidity and avoiding additional large downside risks to economic growth," said Huang Yiping, an economist with Barclays.

This shift is in part being driven by three causes:

First, there are tentative but widespread signs suggesting that economic activity has improved in the past month or two.

Second, inflation has always been a great concern for officials with the People's Bank of China, the country's central bank, and that's probably even more true now as growth bottoms out and the developed world turns again to quantitative easing.

Third, the central bank is worried that further monetary easing will boost housing prices again.

"This is in line with our expectation of no more rate cuts in the coming quarters," Huang said. "But we cannot rule out the possibility that banks' reserve requirement ratio will be further lowered as a way for the central bank to manage liquidity conditions. Of course, these expectations are based on our assessment that economic growth is bottoming out.

"If growth decelerates sharply in the coming months, especially if job losses become an economy-wide problem, then the central bank could ease monetary policy aggressively to cushion further downside risks to the economy."

- Globalfoundries partners with Chinese city Chongqing on chip-making JV

- Private sector welcomed to invest in farmland irrigation

- Russian experts, officials confident about China's economy, currency

- Kenya, Chinese firm ink deal on key road construction

- World energy leaders agree at intl forum to expand clean energy deployment

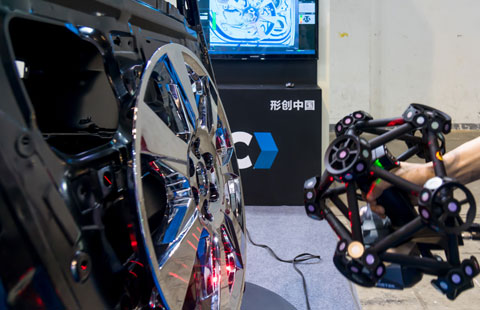

- Shanghai's 3D printing expo attracts over 100 companies

- US subpoenas China's Huawei in probe over exports to Syria, others: NYTimes

- Sportswear or examwear? Nike store targets exam takers in NE China