Need for quality logistics space up

By Hu Yuanyuan (China Daily) Updated: 2012-12-31 10:50Higher rental, inadequate supplies may force companies to seek new sites

The rapid growth of the e-commerce sector in China has triggered demand for quality logistics space, with demand often outstripping supply, says a recent market report from real estate service provider DTZ.

|

|

|

An S. F. Express employee riding a tricycle to deliver parcels to customers in Shanghai. The booming e-commerce market is fuelling demand for logistics services in China, a market that is characterized by a severe shortage of modern logistics stock. Gao Jianping / For China Daily |

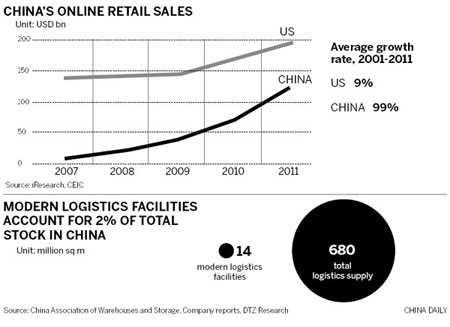

According to the report, China is set to overtake the United States as the largest e-commerce market in the world by 2015, driven by rising domestic consumption, a fragmented retail market and an expanding number of Web users. By 2015, the number of Internet users in China will rise to over 700 million from the present 500 million, making it the largest e-commerce market in the world, it said.

However, the growing market will also create challenges for e-commerce companies as they will need to find ways to make more efficient deliveries to the more than 220 million online shoppers in China to stay ahead. Limited infrastructure, lack of warehouse space and the shortage of last-mile delivery expertise often makes it difficult for e-commerce companies to provide efficient services in the lower-tier cities and inland areas.

For investors and developers, the scarcity of suitable land is also an ongoing issue. Investors should consider investing in large companies with existing land banks, or in those that are redeveloping old facilities, the report said.

The booming e-commerce market has also transformed the supply chain from being supply-driven to demand-led. This has important ramifications for logistics property in terms of site selection, specification and location.

"We see a growing need for the development of small warehouses adjacent to the city markets," said David Ji, head of Greater China research at DTZ.

Adding to the challenge is the severe shortage of modern logistics properties. Modern logistics facilities account for just 2 percent of the total stock in China, meaning that the majority of property comprises middle- and low-end premises, mostly converted from factories and poorly constructed facilities, with inadequate height, insufficient loading docks and restricted vehicle accessibility.

The lack of supply has also contributed to higher rentals in the first tier markets, with logistics rents going up by 85 percent in some districts of Shanghai during the past year. The higher rentals have prompted many e-commerce companies to relocate their warehouses to lower cost regions, the DTZ report said.

Special Coverage

Logistics industry in fast lane

Related Readings

Ministry stresses logistics, consumption

China's logistics industry picks up

China's e-commerce market 'faces logistical challenge'

- Robotics experts needed in shifting economy

- Video-gaming offers rich rewards

- Rare earths firms go high tech to tap world market

- Glut and loss in the time of steel ferment

- Consistency, commitment key to reforms

- Low inflation marks weak growth

- China's securities firms make over 62b yuan profit in H1

- BP seeks buyers for petrochem JV stake