Chinese offshore-rig builders aim for top spot

By Meng Jing (China Daily) Updated: 2013-01-14 10:22"Building an offshore drilling rig usually takes three years. It may be hard to believe, but the delivery of one of our rigs was delayed for almost a year because of our lack of experience."

Liu Yanjia, vice-president of CIMC Raffles, says it usually takes 30 months for a Singapore company to finish a drilling platform, but because of a lack of management experience in his company, it needs 35 months to build something comparable. "A longer production process means higher production costs," he says.

Given buyers' concerns on delivery reliability, China remains a distant No 3 in terms of offshore rig-building market share, a report from Reuters says. In the first half of last year China secured just three orders out of the 29 placed during the period, against 11 for South Korea and six for Singapore, data from Credit Suisse shows.

However, Gao says his company and its Chinese peers can overcome that shortage with their growing experience in building rigs. Industry insiders agree, saying the technology gap between Chinese offshore rig builders and their rivals can be closed in a relatively short time. What is hurting at the moment is the gap between management and operational expertise.

Gao says that construction of one of the rigs CIMC Raffles is building is ahead of schedule. With an increasing number of orders resulting from the boom in offshore oil exploration, the company will soon gain more experience, he says.

The company, which delivered three rigs last year, has three incoming orders and is now building a total of seven, he says.

Despite the years of development and the achievements the company has made, Gao acknowledges that it still has a long way to go.

In a mid-to-long term ocean-equipment industry development plan the government issued in March 2012, it said the country expected to boost its share of the global offshore energy equipment industry to 20 percent by 2015 and to 35 percent by 2020, from less than 8 percent in 2011, and nurture five to six world-class companies that are set to have annual revenue of 40 billion yuan each by 2020.

"The key obstacle to achieve that goal is to establish a full supply chain of offshore equipment building in China," says Yu Ya, the president of CIMC Raffles, which plans to be one of the five to six world-class companies that China aims to have by 2020.

"I can find all the suppliers our company needs in Singapore in two hours, but in Yantai even if I spend two days searching, I may still end up with no suitable suppliers at all."

It is sometimes frustrating to think that a high-end manufacturing company like his has fewer options for suppliers than a local seafood factory, he says.

mengjing@chinadaily.com.cn

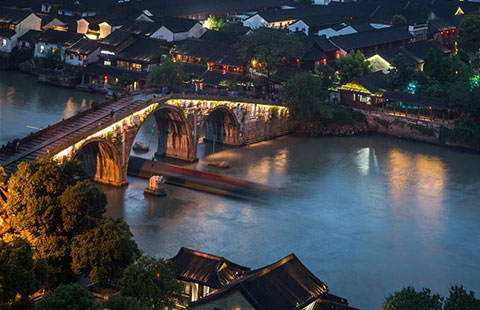

- Zhejiang province: Everything and more

- Zhongan says favors IPO in Hong Kong

- China warns online game operators

- China to grade provincial governments' food safety performance

- China's HeSteel breathes life into old steel factory in Serbia

- China to boost solar, wind power cooperation with Namibia

- China is in urgent need of a new round of transition: Economist

- Aviation shares lift off on Aero Engine debut