Challenges ahead to make yuan a global currency

(Xinhua) Updated: 2013-01-14 16:21MANILA - China needs to address stability and liquidity issues before it can realize its plan to internationalize the yuan and challenge the global dominance of the US dollar, a prominent economist said in a recent forum held in the Philippine capital.

"An international currency that is widely used in private commercial and financial transactions and is held by central banks as reserves has three essential attributes: scale, liquidity and stability," Barry Eichengreen, distinguished professor of economics and political Science at the University of California, Berkeley, said in a forum organized by the Asian Development Bank.

Eichengreen, a former senior policy adviser at the International Monetary Fund, said China has already achieved the first precondition to yuan's success as a global reserve currency - scale. Next only to the United States, China is now the world's second largest economy. Economists have predicted that China will soon overtake the United States as the world's biggest economy.

But Eichengreen notes, "scale while necessary for international currency status is not sufficient." He cited the case of the United States, which back in 1913 was already the world's biggest economy, but even that was not enough for the dollar to dislodge the sterling as the global currency of choice.

The United States back then failed to meet other pre-conditions that will lead to the internationalization of the greenback, liquidity and stability. China, he said, is now in the same position.

China's fast rising economy has encouraged its policy makers to push for the yuan as a global currency reserve by promoting its use in overseas markets. To this end, China has allowed local companies to use the yuan in cross-border trade settlements. It has also permitted foreign investors to invest yuan-denominated funds in China's interbank bond market and signed currency-swap agreements with the Philippines, South Korea, Japan, and Australia.

While China is opening its financial markets, Eichengreen said liquidity remains a challenge. China's bond markets remain small and trading volume is low. Liquidity is a main consideration for central banks when they're considering currencies to hold as a reserve.

Eichengreen also cited the importance of stability, which he said is the most difficult thing to establish given that it has several dimensions political, economic and financial.

Political stability, for instance, will ensure a stable policy environment for investors who will allocate a certain portion of their portfolio to the yuan. Eichengreen suggested that China's regulatory agencies need to be independent "to foster confidence that regulatory decisions are taken with economic stability rather than political considerations in mind."

Special Coverage

Related Readings

Global use of yuan on the rise

A more global yuan

RMB to appreciate 2%-3% against USD in 2013

Bigger global role for RMB in 2013

- Global use of yuan on the rise

- Yuan touches 19-year high as report forecasts growth

- Chinese yuan at 8-month high against dollar

- Higher pay and stronger yuan slow hiring

- Offshore yuan business to make way into Europe, US

- The steady advance of the yuan

- A more global yuan

- RMB to appreciate 2%-3% against USD in 2013

- Bigger global role for RMB in 2013

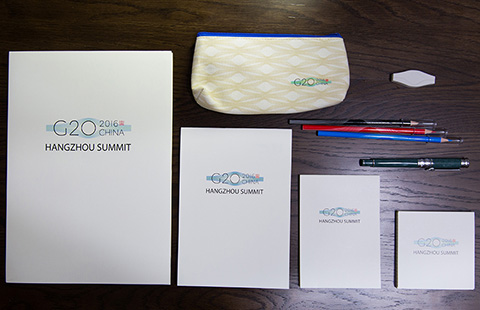

- Chinese wisdom to aid economic recovery, G20 transition

- ICBC posts 0.8% rise in net profit for first half

- Macao's GDP down 7.1% in second quarter

- Hangzhou, an English-friendly city

- Experts call for more steps to develop AI technology

- Starbucks launches Teavana brand in China

- Students learn about G20 countries in Zhejiang province

- Samsung launches Note 7 in China