A different investment climate in China doesn't mean it is worse

(Xinhua) Updated: 2013-01-28 09:57DAVOS, Switzerland - China's investment climate for foreign companies is different now from what it was a decade ago, but it is far-fetched to say the investment climate has become worse, world business leaders has told Xinhua.

"China's investment climate has changed in the last decade, and requires a different investment approach, but 'different' doesn't mean 'worse'," said James S Turley, chairman and chief executive officer (CEO) of corporate audit giant Ernst & Young.

The remarks were made by Turley in an interview with Xinhua on the sidelines of the ongoing annual World Economic Forum (WEF).

He said investing in China is still an important part of many Western companies' strategies, but "valuations of Chinese companies and a changing regulatory environment" mean that investors need to think about things differently.

"Ten years ago, there was great opportunity for multinationals seeking to buy Chinese companies to access low-cost manufacturing. Now China has moved up the value chain and Chinese companies and policy makers are also more sophisticated in their dealings with foreign investors."

Turley highlighted the need for foreign investors to be "thinking about smaller acquisitions, partnerships, joint ventures and minority stakes, that is, taking a portfolio approach rather than looking for single large deals."

Mark Spelman, global head of strategy at Accenture, one of the world's largest technology consulting company, said there is no such a consistent picture where China's investment environment has been fundamentally worsening.

Concerning the so-called worsening investment climate, Spelman said, "It's not a consistent picture, but that's very true of what is going on in the global economy."

Speaking to Xinhua on the sidelines of the ongoing WEF, he added that, "The answer is that it is mixed, but it is mixed in many countries."

"So I don't see there is a fundamental problem between what is happening in China relative to what is happening in Indonisia, India or other countries," he said.

Spelman pointed out that the investment climate varied by sector, and suggested investors to "recognize that regulatory structures moving at different rates in different countries. "

While concerns had been expressed in certain sectors, "I still think there is plenty of evidences you got western companies continuing to invest in aircraft, in cars, leisure industry," he said.

- China's healthcare M&A deals surge in H1

- China's property loans surge in Q3, home prices curbed

- GAC Fiat Chrysler to recall 68,699 vehicles over gear box problems

- Sino-French JV to develop giant cargo airship

- Asian regional financial cooperation to bring new growth momentum

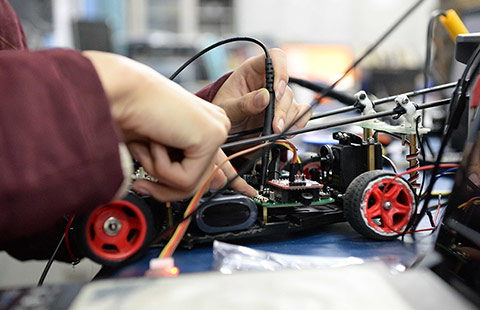

- Intelligent vehicle innovation club in NE China

- 'Core tech needed' for robotics

- Housing prices begin to stabilize in key cities