Nation's wind farms heading offshore

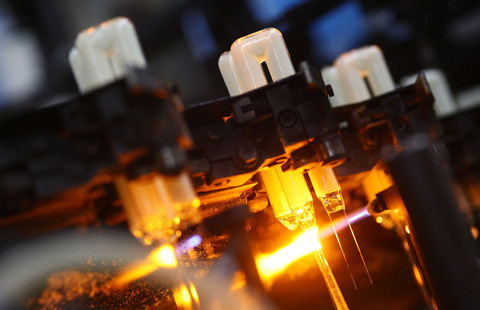

By WANG QIAN and JIANG XUEQING (China Daily) Updated: 2013-01-29 03:34China's wind farms are moving offshore, with the largest project going into commercial use in coastal Jiangsu province.

The 150-megawatt farm opened off Rudong county in November and will supply up to 190,000 residents with renewable energy a year, according to the China Longyuan Power Group, which runs the farm.

"It marks the country's entry into the new era of developing large, offshore wind-energy projects," said Zhou Qinsheng, a climate and energy expert with Greenpeace.

A Greenpeace report last year said wind energy in southeastern China can generate 500 gigawatts of power, about twice the country's hydropower consumption in 2012 of about 249 gW, according to the State Electricity Regulatory Commission.

Compared with onshore wind farms, offshore facilities are competitive in terms of wind resources, land and ecology, Zhou said.

China's offshore wind power generating capacity is expected to reach 5 gW by 2015 and 30 gW by 2020, according to the 12th Five-Year Plan (2011-15) on wind power. "It is a huge market. China is a newcomer and a fast learner," Zhou said.

However, he warned wind power companies to think twice before rushing into the market because it entails high costs and demanding technologies.

He estimates that the early-stage assessment for a potential offshore wind farm takes three to five years — sometimes dozens of years — and the costs are at least double those of land projects, with additional seabed cables to be installed and high maintenance fees.

Jia Nansong, a spokesman for China Longyuan Power Group, said in November that the average cost of offshore wind power is 15,000 yuan ($2,409) a kW, about 5,000 yuan more than that generated through hydropower.

Despite the difficulties, Goldwind Group, one of China's biggest manufacturers of wind power equipment, has stepped into the market, supplying 20 wind turbines of 2.5 megawatts each to the intertidal wind farm operated by China Longyuan Power Group in Jiangsu.

- SOEs hit reduction goal

- University tie-ups unleash innovation

- Pledge on AT&T offers fees and risks

- GE reaps Belt and Road dividend

- CRRC eyes high-speed new maglev

- Chinese firms feel burdened by rising costs: report

- DJI's drones to home in on specific industries

- Major lenders prepare for yuan internationalization