Baosteel looking to boost sales

|

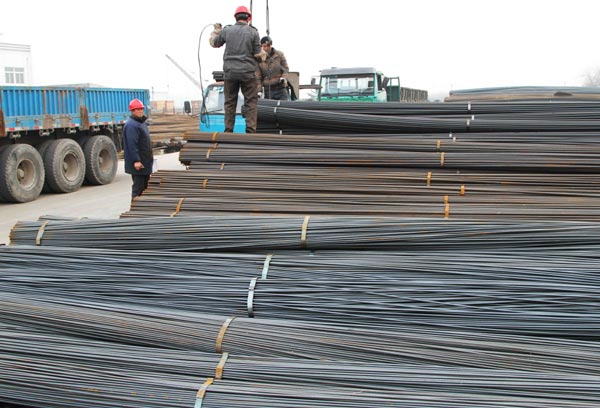

Workers prepare reinforced steel bars for shipment in Nantong, Jiangsu province. China's demand for steel and iron ore is closely monitored as it largely serves as the sector's barometer and affects the profitability of major mining firms. [Photo/China Daily] |

Firm sets sights overseas to offset domestic woes

Baoshan Iron and Steel Co Ltd, China's largest listed steelmaker, aims to double its overseas sales to offset severe domestic overcapacity.

The company, with headquarters in Shanghai and which is also known as Baosteel, aims to raise overseas revenue from 10 percent to 20 percent by 2018, possibly helped by a joint venture to be set up in an emerging market, said chairman He Wenbo.

Baosteel wants to diversify its overseas portfolio by building production plants and research centers in the next six years, He told China Daily.

He said this global ambition will be realized most likely through a joint venture in a populous country in Southeast Asia or South America.

But the goal may also be achieved through mergers and acquisitions, as well as green field investment - where a parent company starts a new venture in a foreign country by constructing new operational facilities.

Baosteel is searching for foreign partners, as persistent overproduction lingers in China and sluggish demand curbs pricing.

Although iron ore prices have risen by more than 60 percent since their September low, China's major ports have seen their iron ore stockpiles fall to a three-year low, according to The Steel Index, an online iron ore price tracker.

The country's demand for steel and iron ore is closely monitored as it largely serves as the sector's barometer and affects the profitability of major mining firms.

He sees a subdued outlook for this year's steel demand with just 3 percent growth, but predicts the market will see a slight pick-up compared with 2012.

"Last year was the most difficult year for us. We reported a 11.2 billion yuan ($1.8 billion) profit, which was hardly satisfactory," he said.

However, his cautious optimism stems from the burgeoning urbanization the government upholds as a continued driving force for sustainable economic development.

"Fueled by ongoing urbanization, steel will be used in everything from washing machines to construction beams," He said.

Baosteel's complete dependence on overseas iron ore supplies gives it an advantage compared with rivals sourcing ore from more expensive domestic mines, He said.

Therefore, global gloom doesn't necessarily spell disaster for the company, which ranked second worldwide in terms of profitability in 2012. According to He, Baosteel should leverage its resources to reach out for new opportunities.

The company runs 56 overseas initiatives, but the majority are export-led projects on resources exploration and sales services.

He said the firm is flexing its muscles in the export of production capabilities, technology and capital.

The establishment of a research center will be a long-term vision, with Baosteel hoping to develop energy-efficient technologies to lower carbon dioxide emissions.

For instance, the company is embarking on the design of a lightweight and high-strength motor plate, which significantly improves vehicles' performance by reducing a car's weight by 15 percent.

Despite widespread concerns that the steel industry is to blame for many environmental problems, He argues that it is, in fact, a substantial part of the solution.

"If all carmakers apply such materials, it will save up to 17 million tons of carbon dioxide emissions by 2018, equaling the amount of waste gas that 560,000 hectares of forest can absorb," he said.

Following a call to turn Shanghai's economy into a service-oriented one, Baosteel has decided to cut output and partly relocate from its long-term home in the city and move a steel project to Zhanjiang, a less-developed city in Guangdong province.

hewei@chinadaily.com.cn

- Baosteel buys back shares

- Baosteel 2012 profits surge 40%

- Baosteel raises December ex-factory prices on growing demand

- Baosteel's Q3 net profit down 5% to 1.18b yuan

- Baosteel Nov product prices remain flat

- Baosteel: Luojing factory suspends production

- Share buyback plan to cost Baosteel 5b yuan

- Baosteel H1 profits surge 89%