Major firms grab larger slice of property market

|

|

|

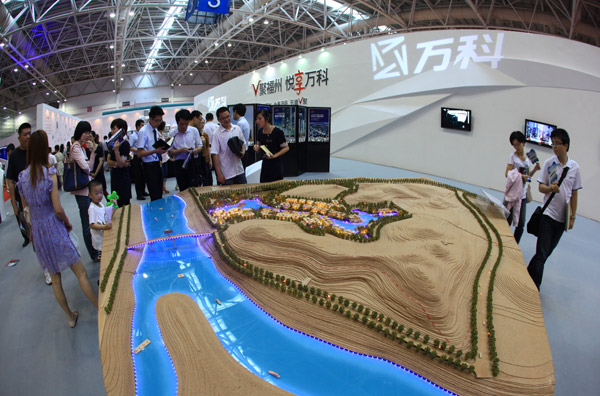

A housing fair in Fuzhou, Fujian province, on May 26, 2012. China's major property developers are grabbing bigger market shares. [Provided to China Daily] |

China's major property developers are grabbing bigger market shares, and higher revenues from the market reshuffle brought about by tightening policies, according to the latest real estate industry statistics.

In the first quarter, the nation's top 10 property developers by sales revenue had a 14.88 percent market share, up from 14.28 percent a year ago, according to a report released on Tuesday by China Real Estate Information Corporation.

Expanding market shares have resulted from the rising sales revenue of these heavyweight developers. Each of the top 10 generated more than 11 billion yuan ($1.77 billion) in the first quarter, with China Vanke Co Ltd taking the lead.

The rising market shares and sales revenue are mainly due to the market pickup since May 2012 as well as the market reaction toward the latest government tightening policy, said Ding Zuyu, executive president of E-House (China) Holdings Ltd.

Data from Jones Lang LaSalle, a global real estate services company, showed that even in the traditional off-season for home sales, in January and February, market transaction volumes in gross floor area for residential property remain bullish, surging 142 percent year-on-year in Shanghai.

More noticeably, home prices began to creep up and many home buyers started to anticipate further growth in the coming months.

According to Ding, sales soared in March after the central government unveiled the policy of levying a 20 percent capital gains tax on sales of pre-owned homes.

"In order to avoid the tax, homebuyers sped up their purchases, and some residential projects were sold out within a day or even a few hours," said Ding.

Centaline Property Agency, a subsidiary of Hong Kong-based real estate agency Centaline Group, generated as much as 790 million yuan in commission fees in March amid the sales boom, which was five to six times the amount in March 2012, added Ding.