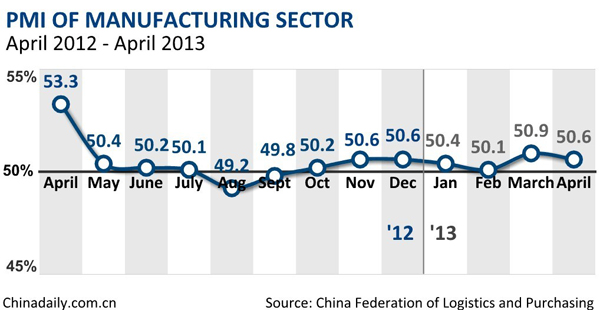

China's manufacturing PMI drops in April

China's Purchasing Managers' Index (PMI) for the manufacturing sector fell to 50.6 percent in April from 50.9 percent in March, the China Federation of Logistics and Purchasing (CFLP) said on Wednesday.

It was the seventh consecutive month in which the PMI figure stayed above 50 percent, which demarcates expansion from contraction, according to a statement from the CFLP.

Although the PMI remains generally stable, the slight retreat indicates slower growth in the manufacturing sector and the need for a stronger momentum in China's economic growth, the statement said.

The April PMI showed that the foundation for China's economic recovery is not solid enough, said Zhang Liqun, an analyst from the Development Research Center of the State Council, or China's cabinet.

The decline in orders caused the fall in the inventory level, and a sharp drop in the sub-index for purchasing prices of raw materials suggests the corporate confidence was undermined, Zhang said.

According to the CFLP, orders received by manufacturers dropped in April, as the sub-index for new orders edged down 0.6 percentage points from the previous month to 51.7 percent.

The sub-index for purchasing prices of raw materials tumbled 10.5 percentage points to 40.1 percent, the first reading below 50 after the sub-index stayed above the demarcation level for seven consecutive months.

The sub-index for finished goods inventories moved down 2.5 percentage points from the previous month to 47.7 percent, while the sub-index for production shrank slightly by 0.1 percentage points to 52.6 percent.

The sub-index for raw materials inventories remained unchanged at 47.5 percent in April, said the CFLP.

The official PMI figure, based on a survey of purchasing managers from 3,000 companies in 21 industries, chimed with the HSBC's flash PMI reading announced last week.

The PMI for China's manufacturing sector fell to 50.5 from March's 51.6 on a 100-point scale, according to the British bank, whose final reading for April is scheduled to be released on Thursday.

Although the PMI figure may further weaken market expectation for a strong rebound in the Chinese economy, the CFLP said the Chinese economy has been showing signs of positive structural adjustments since the beginning of this year.

The April sub-index for new orders in the manufacturing of non-mental mineral products rose by more than 4 percentage points from a month earlier, representing improving demand in infrastructure investment and investment for technological upgrades, the CFLP said in the statement.

It added that the new orders sub-index for equipment manufacturing also remained at a steady, high level.

Meanwhile, the sub-index for new export orders slid again to below 50 percent, indicating uncertainties in external demand, the federation noted.

More efforts should be carried out to tame overcapacity, boost domestic consumption, stabilize prices and encourage economic restructuring, in order to maintain steady and sound economic growth, according to the CFLP.

China's gross domestic product growth unexpectedly slowed to 7.7 percent in the first quarter of 2013, down from 7.9 percent during the final quarter of 2012, data from the National Bureau of Statistics showed in mid April.

Based on the April PMI figures, a slight slowdown in future economic growth could be possible, Zhang Liqun said, stressing that efforts should be made to stabilize domestic demand and improve the sustainability of China's economic recovery.

The CFLP data also showed that the employment sub-index for April declined 0.8 percentage points to 49.0 percent, indicating job cuts, while the sub-index for supplier delivery times fell slightly to 50.8 percent.

The business outlook sub-index came out 6.2 percentage points lower from a month earlier to 59.3 percent, meaning that fewer manufacturing companies were optimistic about their business activities in the next three months.